- Pivot & Flow

- Posts

- Dec. 1st Market Overview

Dec. 1st Market Overview

December 1st Market Overview (no fluff)

Happy Monday

We slid a bit to start December after Japan said they're hiking rates December 19th. Investors borrowed cheap yen for over a decade to buy stocks and bonds - Wall Street calls this the "yen carry trade."

Higher rates mean that borrowed money gets expensive, forcing asset sales to pay back loans. I'm watching if this gets worse before the Fed meeting next week.

Let's dig in...

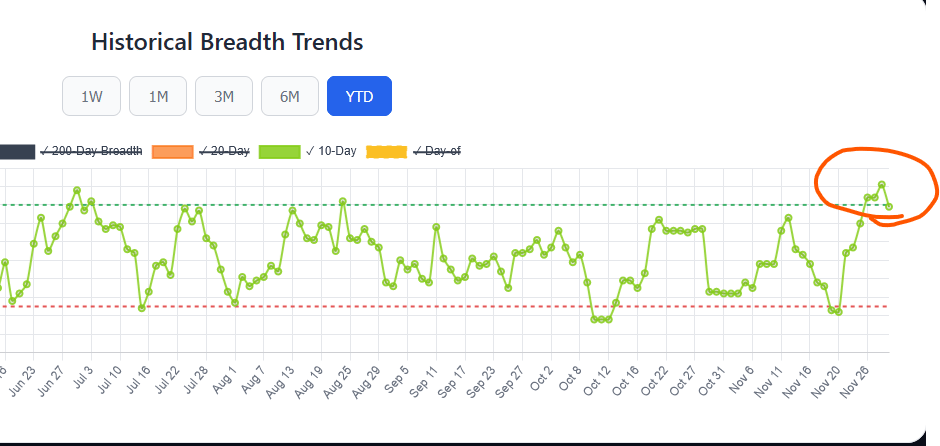

The Market Health Dashboard signaled over-extension last week in the most beautiful way.

Available to ALL premium members.

Today's Big Picture

Japan Signals Rate Hike, Carry Trades Unwind

Bank of Japan Governor Ueda signaled a rate hike at the December 19th meeting. Markets now price 75% odds for December, 95% by January. Japanese 10-year yields hit 1.88%, highest since 2008. The 20-year reached 2.88%, not seen since 1999.

Cheap yen has funded trillions in global speculation. When that funding gets expensive, leveraged assets collapse first.

Retail Strong, Manufacturing Weak

Black Friday online sales reached $11.8 billion, up 9% year-over-year. ISM manufacturing dropped to 48.2, the ninth straight month of contraction. ISM chair Susan Spence: "It really is all about tariffs."

Bitcoin Crashes Below $85,000 on $600M Liquidations

Bitcoin dropped below $85,000, down 30% from October's $126,000 high. $600 million in leveraged longs liquidated in 12 hours.

Bitcoin trades 24/7 so it moves first when borrowed money unwinds. Cheap yen funded everything - crypto, stocks, bonds. Japan just made that expensive.

P.S. Don’t put off learning about AI, its scary but it’s also exciting and can be helpful and ethically utilized.

Some Friends at Outskill are putting on a free learning workshop this weekend. Check it out and learn some useful new skills.

Market Overview

Chart of the Day

Stock Spotlight

Synopsys $SNPS ( ▲ 2.63% )

jumped after Nvidia $NVDA invested $2 billion at $414.79 per share in a strategic partnership on AI chip design tools.

Coinbase $COIN ( ▼ 1.54% )

and Strategy $MSTR both tracked bitcoin lower. Strategy fell to its lowest level in 14 months.

Shopify $SHOP ( ▲ 3.97% )

fell after its platform went down on Cyber Monday. The Admin system outage lasted well into the afternoon.

Big Name Updates

Tesla $TSLA ( ▼ 0.1% )

set an all-time sales record in Norway with 28,606 vehicles through November, beating Volkswagen's previous record. TD Cowen maintained buy rating with a $509 target after testing RoboTaxi rides in Austin.

Apple $AAPL ( ▼ 0.85% )

got an overweight reiteration from JPMorgan with a $305 target. iPhone 17 base model lead times remain in double digits and increased across most models versus last week.

Nvidia $NVDA ( ▲ 0.16% )

received a sell rating from Seaport Global with a $140 target on growing competitive pressure. The analyst noted Nvidia has $26 billion in cloud compute service agreements not fully reflected in financials.

Broadcom $AVGO ( ▲ 4.8% )

got a $460 price target from Bank of America. The analyst sees Google TPU prices reaching $12-15k per unit next year on 3 million units, up from $5-6k on 2 million units this year.

Other Notable Company News

Moderna $MRNA ( ▼ 6.87% )

and Novavax $NVAX fell after an internal FDA memo said staff judged at least 10 of 96 pediatric deaths as possibly linked to COVID vaccines. Findings aren't peer reviewed yet.

Wynn Resorts $WYNN ( ▲ 1.97% )

made Goldman's conviction buy list on strong Las Vegas operations and Macao recovery potential.

Airbus $AIR ( ▼ 6.66% )

fell after regulators ordered urgent fixes on thousands of planes. A suspected production flaw is also delaying new aircraft deliveries.

Barrick Gold $B ( ▼ 3.02% )

said its board will study spinning off North American gold assets into a separate company.

AMC Entertainment $AMC ( ▲ 2.54% )

said Thanksgiving week was its busiest of 2025 with 6.9 million guests. "Zootopia 2" and "Wicked: For Good" drove record traffic.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

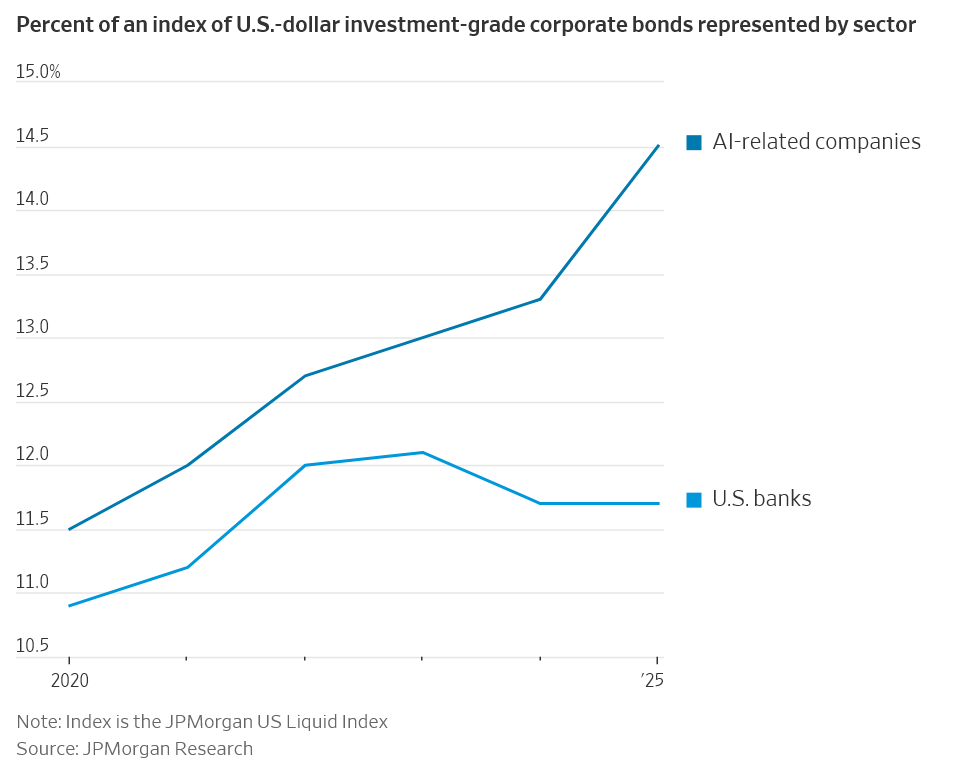

Bond Market

The 10-year Treasury settled at 4.10%. Japan's rate hike signal pushed yields higher along with heavy corporate bond issuance.

Tomorrow: ADP employment report. Friday: September PCE inflation data, the last inflation print before the Fed's December 10 decision.

Policy Watch

Fed Chair Speculation

Trump said Sunday he's picked his Fed chair nominee but didn't reveal the name. Prediction markets:

Kevin Hassett: 75% odds (Kalshi and Polymarket) prediction markets have been fairly accurate for this kind of stuff

Christopher Waller: 8%

Kevin Warsh: 14%

Hassett leads the National Economic Council and is viewed as most likely to cut rates aggressively.

Fed Meeting Next Week

CME data shows traders expect a 25 basis point cut December 10

Bank of America expects that cut with terminal rate unchanged

Powell speaks tonight at 8pm but is in blackout period

Manufacturing

ISM manufacturing hit 48.2, ninth straight month of contraction. New orders fell, backlogs declined, supplier deliveries dropped 4.9 points to 49.3. ISM chair Susan Spence: "It really is all about tariffs."

Trade

US and UK announce zero tariffs on pharmaceutical products today.

International

OPEC+ paused output increases through 2026 despite crude at $63

Ukrainian drones hit Russia's shadow fleet vessels and a Black Sea export terminal

European defense stocks fell after US and Ukraine made progress on ending the war

Today’s Sponsor

AI Mastermind —> Free This Weekend Only

Outskill is running a live 2-day AI workshop this Saturday and Sunday (10 AM–7 PM EST both days).

It normally costs $395. This weekend, it's free for the first 100 signups.

You'll learn how to build AI agents, automate workflows across tools like Notion and Google Sheets, and actually use AI beyond basic ChatGPT prompts.

Trustpilot rating: 9.8/10

They're also throwing in some bonus materials like prompt libraries, monetization guides, etc.

Worth checking out if you've been meaning to level up on AI but haven't carved out the time.

What to Watch

ADP Employment Report Wednesday

November private sector jobs data drops Wednesday morning. A weak print challenges the soft landing narrative heading into the Fed decision.

PCE Inflation Data Fridayw

September PCE arrives Friday at 10am, the last inflation print before the Fed's December 10 decision.

Retail Earnings This Week

Dollar Tree and Macy's report Wednesday. Dollar General Thursday. Any guidance disappointment pressures the consumer sector.

Japan Rate Decision December 19

BOJ meets December 19 with markets pricing high odds of a hike. If they deliver, investors who borrowed cheap yen to buy other assets will keep selling. The yen strengthens further.

Thanks for reading 🙂

- John

Today’s Sponsor

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Note: This newsletter is intended for informational purposes only.