- Pivot & Flow

- Posts

- August 27th Market Overview

August 27th Market Overview

August 2th Market Overview (no fluff)

Happy Wednesday

Weird day, we hit new highs but everyone’s just killing time before Nvidia reports tonight. The market's been in this holding pattern all week, kinda like waiting for test results your a bit anxious about.

Folks yesterday asked me to clarify my opinion on Trump's Fed drama with Lisa Cook. I started this with a goal in part to be market focused, that means my personal political opinions get put on the back burner. I’m here to talk about the market and what effects it.

Let's dig in...

P.S. You’re’ making better decisions from reading this.

Some readers help fund it.

Your move → Premium Subscriber

Today's Big Picture

Nvidia Earnings Define Market Direction

Wall Street expects record $46 billion revenue, but guidance and China business commentary will determine if the AI rally continues.

AI Spending Proves Real MongoDB

$MDB ( ▼ 2.42% ) crushed expectations with revenue driven by companies building AI platforms, raising its full-year outlook as analysts hiked price targets. The database company's results provide concrete evidence that ai investments are translating into actual business growth.

Fed Independence Battle Keeps Rates High

Trump's push to fire Governor Lisa Cook despite legal challenges is creating a risk premium in Treasury yields. The constitutional fight over central bank independence is preventing bond rallies even as economic data suggests room for rate cuts.

Tariff Costs Hit Corporate Profits

India tariffs doubled to 50% at midnight while J.M. Smucker $SJM ( ▼ 0.04% ) warned of more coffee price increases this winter. The food company's tariff-driven losses signal broader inflation pressures as trade conflicts escalate across multiple countries.

Market Overview

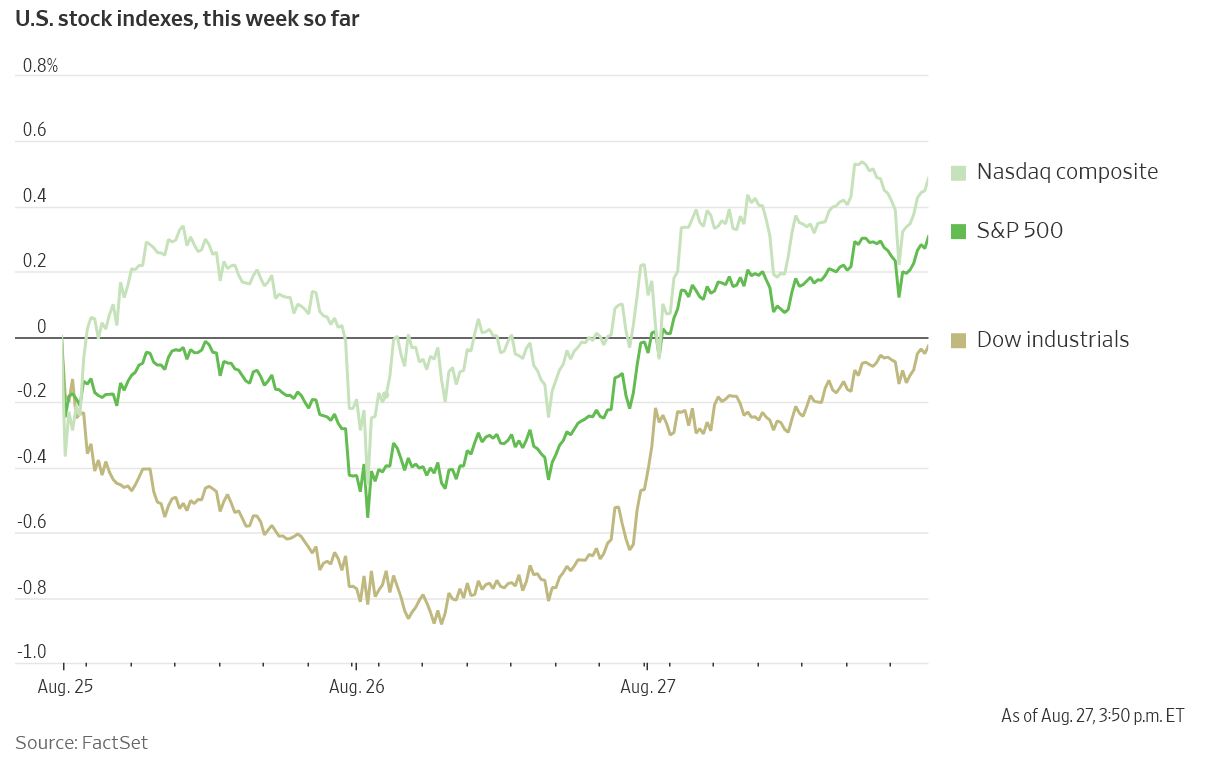

U.S. Stock Indexes

Stock Spotlight

MongoDB $MDB ( ▼ 2.42% )

delivered AI validation with revenue beating estimates as companies building artificial intelligence platforms drove demand. The database company raised its full-year outlook, prompting Citi to boost its price target to $425.

Kohl's $KSS ( ▼ 6.19% )

turned in a retail surprise with adjusted earnings nearly doubling analyst expectations. The department store chain also topped revenue forecasts and raised full-year guidance, signaling operational improvements are working.

American Eagle $AEO ( ▼ 1.37% )

gained on a collaboration with Travis Kelce's Tru Kolors brand. The timing capitalized on Kelce's engagement announcement with Taylor Swift, though the partnership was over a year in development.

Big Name Updates

Nvidia $NVDA ( ▼ 4.17% )

got a bearish call from Lynx Equity ahead of tonight's earnings, with the firm downgrading to Neutral over concerns about GPT-5 reception impacting demand for next-generation GB200 chips.

Apple $AAPL ( ▼ 3.21% )

set its iPhone 17 event for September 9, five days after Huawei unveils a tri-fold smartphone on September 4. The timing sets up a competitive fall in premium phones.

Microsoft $MSFT ( ▼ 2.24% )

benefits from OpenAI's $8 billion employee share sale at a $500 billion valuation, validating the AI partnership's strategic value.

Amazon $AMZN ( ▲ 1.0% )

is expanding Project Kuiper to Vietnam, seeking to provide satellite internet services as competition with SpaceX Starlink intensifies globally.

Other Notable Company News

Cracker Barrel $CBRL ( ▲ 1.11% )

ditched its new logo for the classic "Old Timer" design after customer backlash on social media.

Canada Goose $GOOS ( ▼ 1.44% )

attracted takeover bids valuing the luxury parka maker at $1.35 billion, with Bain Capital looking to sell its controlling stake.

Walmart $WMT ( ▲ 2.84% )

launched next-day delivery for third-party marketplace orders in major cities as it pushes toward U.S. e-commerce profitability.

SpaceX hit critical Starship milestones on its 10th test, opening payload doors in space and deploying Starlink simulators for the first time.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year yield is stuck around 4.27% because nobody knows what Trump's going to do with the Fed.

Sure, inflation data suggests rates could come down, but all this drama with firing Lisa Cook has bond investors nervous. When you don't know who's going to be making rate decisions, you demand extra yield to stick around is basically whats going on.

Policy Watch

Fed Drama Keeping Yields High

Trump's trying to fire Governor Lisa Cook and the whole mess is keeping bond prices down. Kevin Hassett basically told her to take a hike while they hunt for new Fed board members. The market doesn't like uncertainty around who's calling the shots on interest rates.

India Tariffs Hit 50%

These new tariffs doubled overnight because Trump wants India to stop buying Russian oil. Problem is, companies like J.M. Smucker $SJM are already passing costs to consumers with higher coffee prices. More countries getting hit with tariffs means more inflation pressure.

Constitutional Fight Brewing

The Fed says they'll follow whatever the courts decide about Cook's firing. This could end up at the Supreme Court and change how much power presidents have over independent agencies. Either way, the uncertainty isn't helping bonds.

Today’s Sponsor

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for high-net-worth entrepreneurs, executives, and professionals across multiple industries. No membership fees.

Connect with primarily self-made, 30-55-year-olds ($5M-$100M net worth) in confidential discussions, peer advisory groups, and live meetups.

Access curated alternative investments like private equity and private credit. With $100M+ invested annually, leverage collective expertise and scale to capture unique opportunities.

What to Watch

Nvidia Earnings Call at 5 PM ET

Listen for Rubin processor details and any China business updates. Management's commentary on GB200 demand will drive tomorrow's reaction across AI stocks.

August Jobs Report September 5th

First major economic data after Nvidia clears the deck. Will shape the Fed's September rate decision and test the current dovish pivot.

Fed Chair Nomination

Trump's selection will signal his approach to monetary policy and central bank independence. Major market-moving announcement expected this fall.

India Trade Retaliation

Monitor New Delhi's response to doubled tariffs. Could affect U.S. agriculture and tech exporters while setting precedent for other trade partners.

Thanks for reading 🙂

- John

Note: This newsletter is intended for informational purposes only.