- Pivot & Flow

- Posts

- 5 Quality Companies I've Got my Eyes On

5 Quality Companies I've Got my Eyes On

High-conviction names below their 200-day moving average

Hey, John here.

I screened for great businesses not trading near highs. Strong returns on capital (20-40%+ ROE/ROIC), clean balance sheets, and prices sitting near or below the 200-day moving average. These are cash machines the market has temporarily discounted.

Quick primer on the metrics:

ROE (Return on Equity): Profit generated per dollar of shareholder money. S&P 500 averages ~15%. Above 20% is strong. Above 30% is a machine.

ROIC (Return on Invested Capital): Same idea but includes debt, so it's harder to fake. Above 15% is solid. Above 25% is elite.

When I find 25%+ ROE and 20%+ ROIC near the 200 DMA, that's a starting point, not a buy signal. I still need the chart to confirm the thesis and understand the macro setup before putting real money to work.

This style of overview will be feature for premium subs…. going over decent setups as they appear.

I'm also building a "Fundamental Scoreboard" as one of the next tools. Like a live leader board of the healthiest companies in the market that you can check anytime.

Anyways, here's what made the cut.

Subscribe now and lock in $9.89/month for both tools+

all premium newsletters I send out.

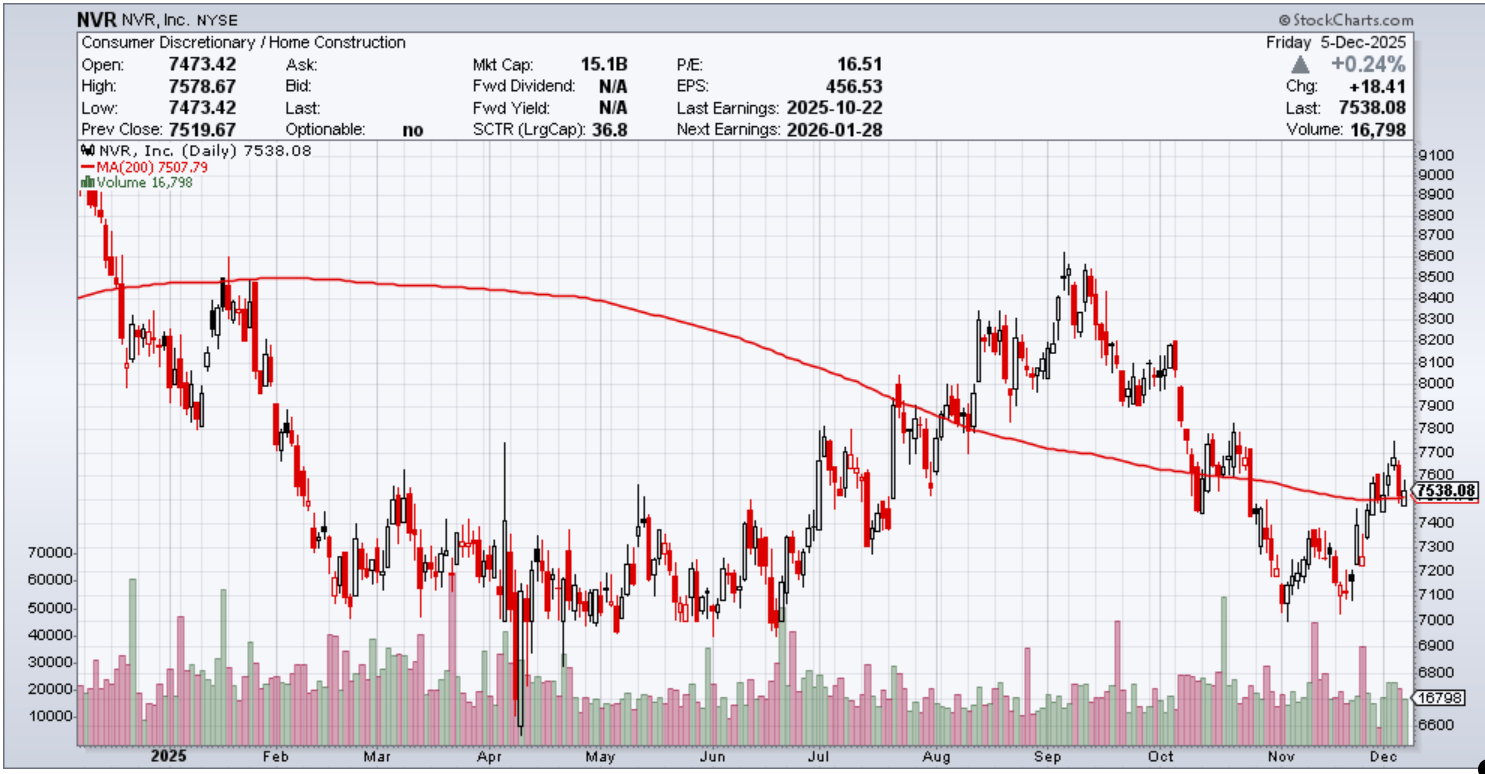

1. NVR Inc (NVR)

The homebuilder that doesn't own land

What They Do

NVR builds homes under the Ryan Homes, NVHomes, and Heartland Homes brands. Here's what makes them different: they don't own land. Instead, they use option contracts to control lots without the massive capital requirements.

This means they're not sitting on billions in depreciating land inventory when the market turns. It's why they were the only major homebuilder profitable through the entire 2008 crisis.

What's Happening Now

The stock is down ~24% from its all-time high around $9,965. The demand picture has softened, Q3 cancellations hit 19% and new orders dropped 16% year-over-year. Quarterly revenue fell 4%.

Silver lining: mortgage rates have cooled to the 6.1-6.3% range, which should help affordability. NVR is still sitting on ~$2.2B in cash with minimal debt and authorized a $750M buyback in August.

The numbers: 36% ROE, 27% ROIC, net cash position, trading at ~17x earnings.

Bull Case

Asset-light model = industry-leading returns through cycles

Housing shortage is structural, existing inventory locked up by rate lock-in effect

~$2.2B cash, aggressive buybacks, Moody's upgraded them

Berkshire Hathaway sold D.R. Horton but kept NVR

Bear Case

19% cancellation rate

New orders down 16% YoY and still declining

Margins compressing as they offer more incentives

Insiders selling, not much buying

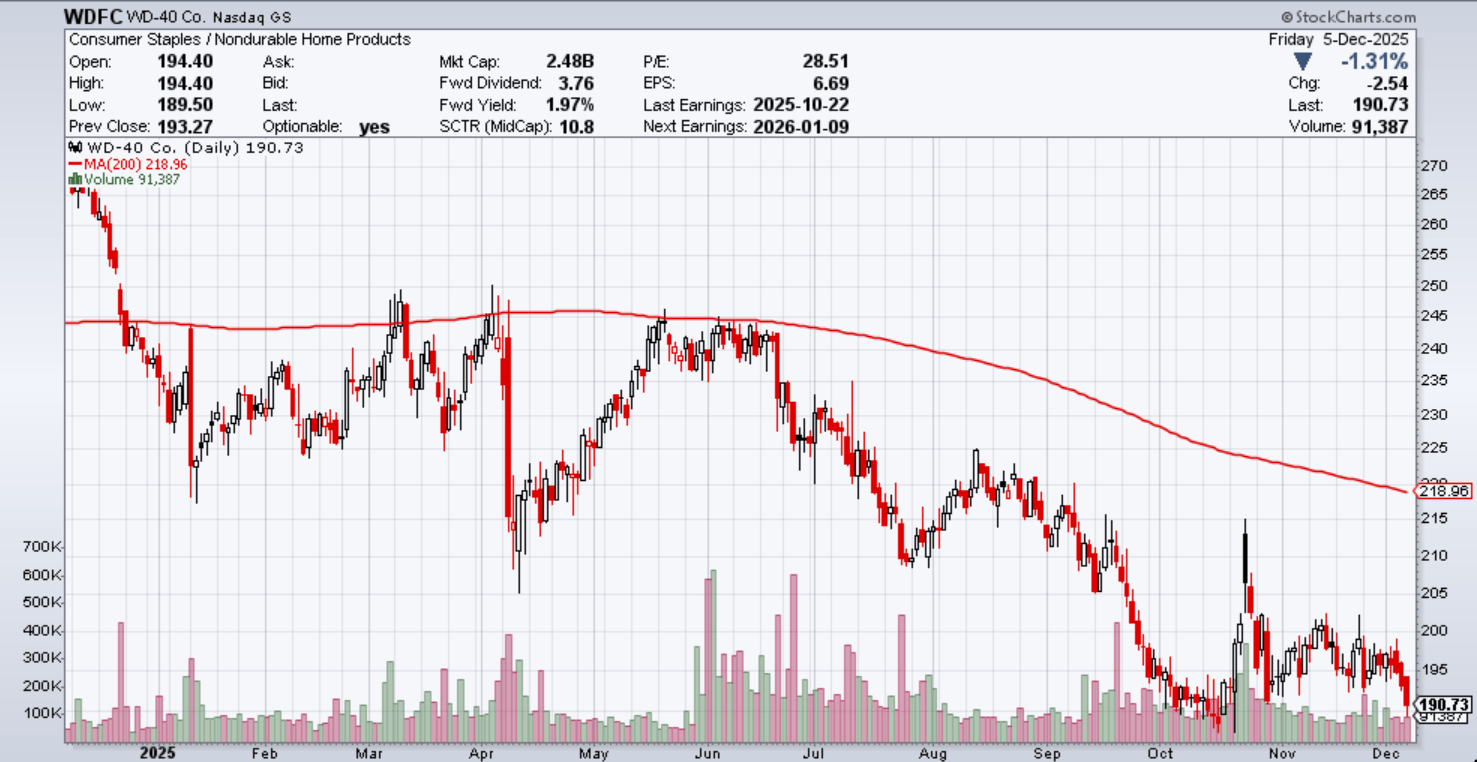

2. WD-40 Company (WDFC)

The moat in a can

What They Do

They sell WD-40. That's basically it. One product, recognized in 176 countries, generating $620M in annual revenue with 55% gross margins. Everyone knows the blue and yellow can. No one's switching to a competitor. This is about as simple and durable as a business gets.

What's Happening Now

The stock is down ~31% from its high around $278. The selloff started after a Q3 miss that showed just 1% growth, but Q4 turned the narrative around. Revenue grew 5% and EPS jumped 27%, beating estimates.

Gross margins hit 55.1% for the full year, with management guiding for 55.5-56.5% next year. Currency headwinds in Europe and Middle East persist, but the core business is executing.

The numbers: 37% ROE, 25% ROIC, net cash, 33 consecutive years of dividend increases, trading at ~29x earnings (down from 43x).

Bull Case

Gross margins expanding, 55%+ with guidance pointing higher

International expansion: China up double digits, Brazil a key growth driver

Premium products (Smart Straw, EZ-Reach) dominate the sales mix

Capital-light compounder with zero debt

Bear Case

Still expensive at ~29x earnings despite the pullback

Growth is steady but not explosive—mid-single digits is the ceiling

Currency headwinds aren't going away

Insiders selling, no buying

Today’s Sponsor

Wall Street Isn’t Warning You, But This Chart Might

Vanguard just projected public markets may return only 5% annually over the next decade. In a 2024 report, Goldman Sachs forecasted the S&P 500 may return just 3% annually for the same time frame—stats that put current valuations in the 7th percentile of history.

Translation? The gains we’ve seen over the past few years might not continue for quite a while.

Meanwhile, another asset class—almost entirely uncorrelated to the S&P 500 historically—has overall outpaced it for decades (1995-2024), according to Masterworks data.

Masterworks lets everyday investors invest in shares of multimillion-dollar artworks by legends like Banksy, Basquiat, and Picasso.

And they’re not just buying. They’re exiting—with net annualized returns like 17.6%, 17.8%, and 21.5% among their 23 sales.*

Wall Street won’t talk about this. But the wealthy already are. Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

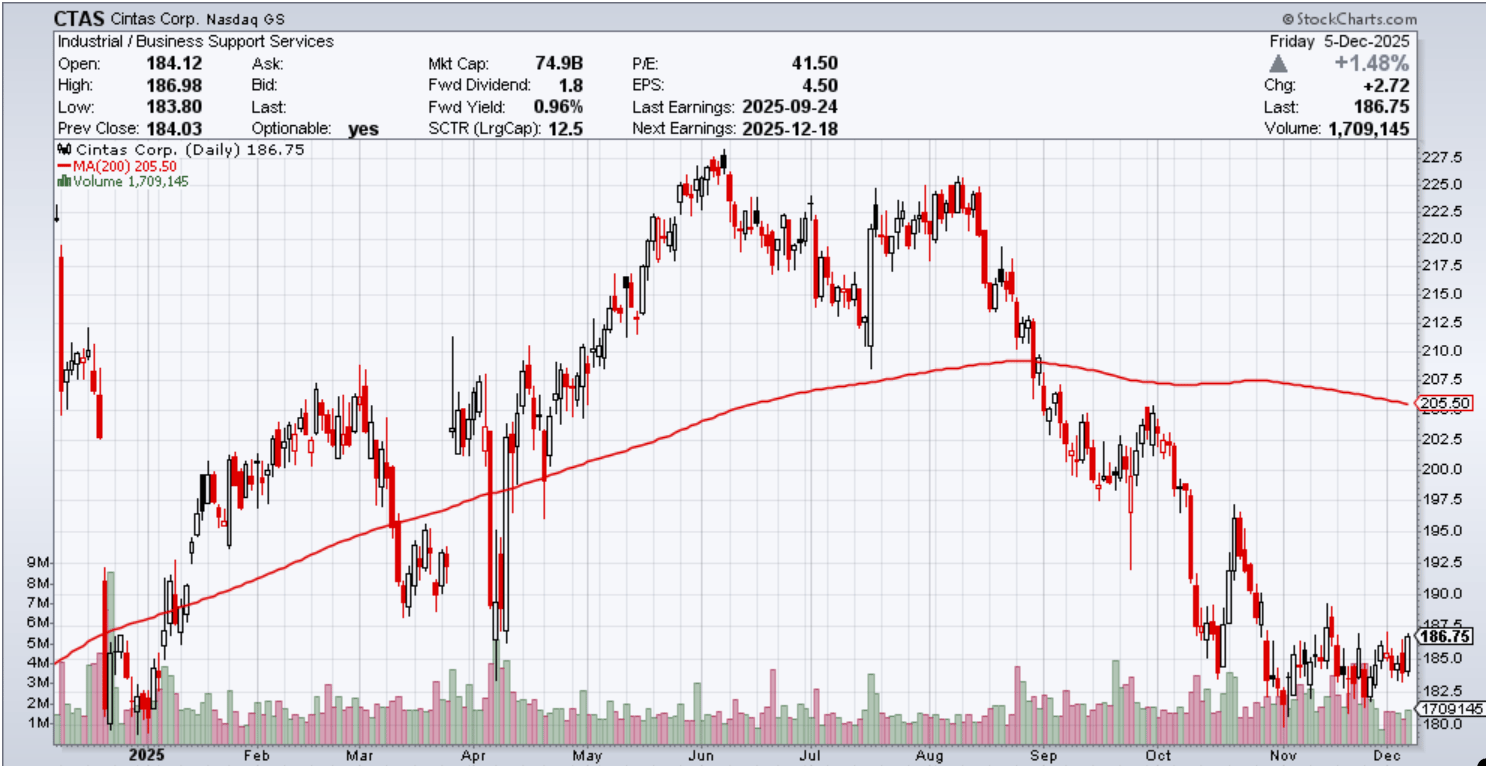

3. Cintas Corporation (CTAS)

The uniform rental near-monopoly

What They Do

Cintas rents and services uniforms, floor mats, restroom supplies, first aid kits, and fire extinguishers to over 1 million businesses. They have 11,500 delivery routes and 460 facilities, a logistics network that took 90 years to build.

Once a customer signs up, they rarely leave. Customer retention is 95%+, compared to sub-90% for competitors.

What's Happening Now

The stock is down ~19% from its mid-year high around $229, though it's roughly flat for the year. The underlying business keeps humming, Q1 FY26 (reported September) delivered $2.72B in revenue (+8.7%), beating estimates.

First Aid and Safety grew 14.4%. Their $5.3B acquisition bid for UniFirst fell apart back in March, removing that catalyst, but the core playbook remains intact. Next earnings drop December 18.

The numbers: 40% ROE, 23% ROIC, 95%+ customer retention, trading at ~42x earnings.

Bull Case

95%+ retention means revenue is essentially recurring

Route density creates a moat no competitor can replicate

First Aid/Safety segment growing 14%+ (diversification working)

60% of new business comes from companies outsourcing for the first time

Bear Case

Pricing power may be normalizing as inflation cools

Premium valuation (~42x) leaves little room for error

Down 19% from highs, market may be skeptical of growth runway

Insiders selling, no buying

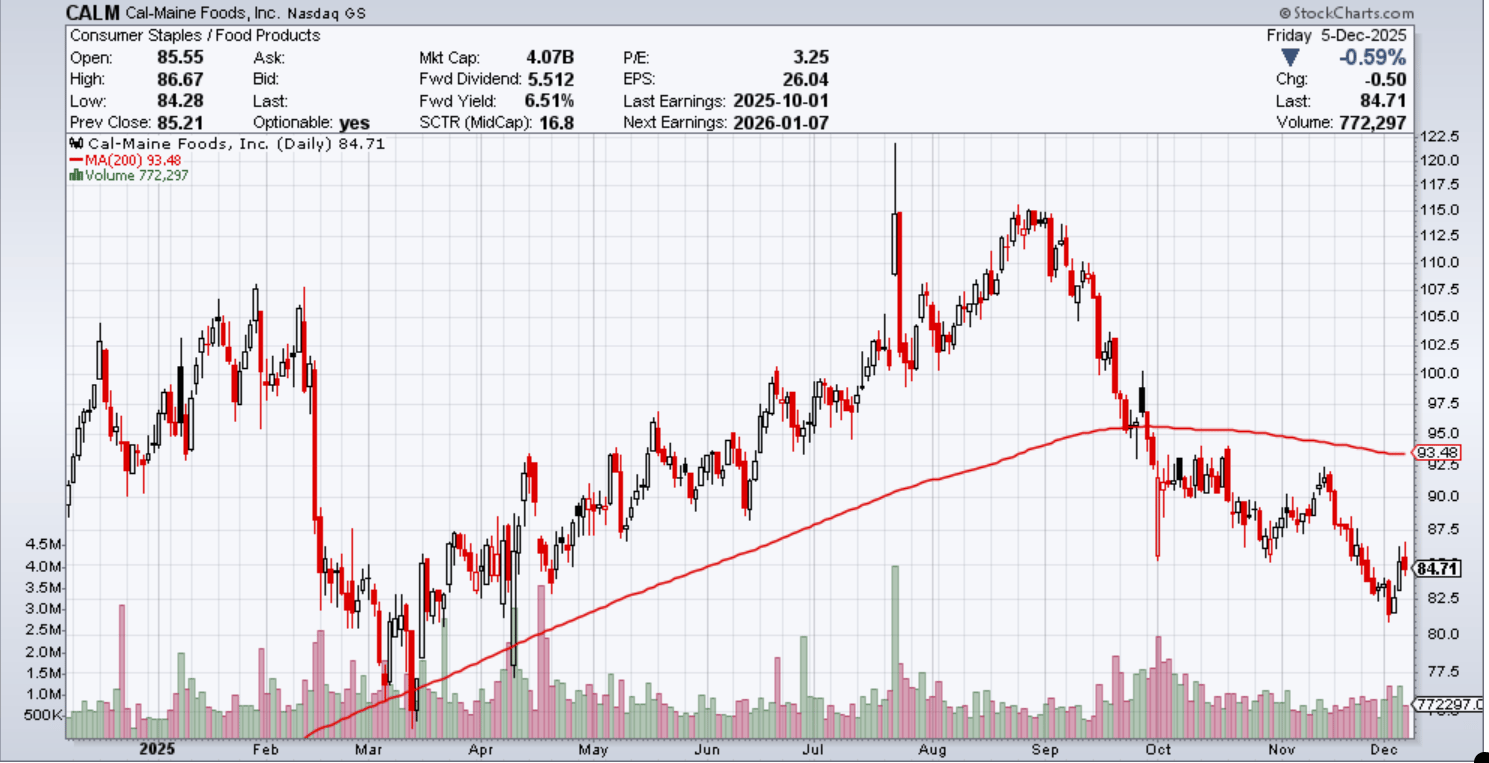

4. Cal-Maine Foods (CALM)

The egg monopoly printing cash

What They Do

Cal-Maine is the largest egg producer in America, controlling roughly 20% of the market. They've grown through acquisitions for decades and benefit massively from scale in a commodity business. When egg prices spike, they make a fortune. When prices crash, their size lets them survive while smaller competitors go under.

What's Happening Now

Avian flu has created an extraordinary supercycle. Over 170 million birds have been culled since 2022,the largest animal disease event in US history. The layer flock is recovering but still hovering near multi-year lows.

Result: egg prices exploded, and Cal-Maine's earnings went from $2.72/share (FY2021) to $25.04/share (FY2025). The stock is down 14% from highs as egg prices have dropped sharply from peak levels but they remain elevated vs. historical norms.

The numbers: 52% ROE (cyclical peak), 41% ROIC, ~$1.25B in cash/investments with ZERO debt, trading at just ~3x trailing earnings.

Bull Case

Insanely cheap at 3x earnings,prices in severe normalization that may not come

Avian flu has no vaccine and this outbreak has lasted 2x longer than 2014-2015

Fortress balance sheet: ~$1.25B liquidity, zero debt, $500M buyback authorized

Variable dividend has been yielding 8-10% on recent payouts

Bear Case

Peak earnings are clearly unsustainable—$25 EPS won't repeat

Egg prices already down sharply—flock rebuilding underway

Founder family sold $280M in stock

Extreme earnings volatility—EPS has ranged from $2 to $25 in four years

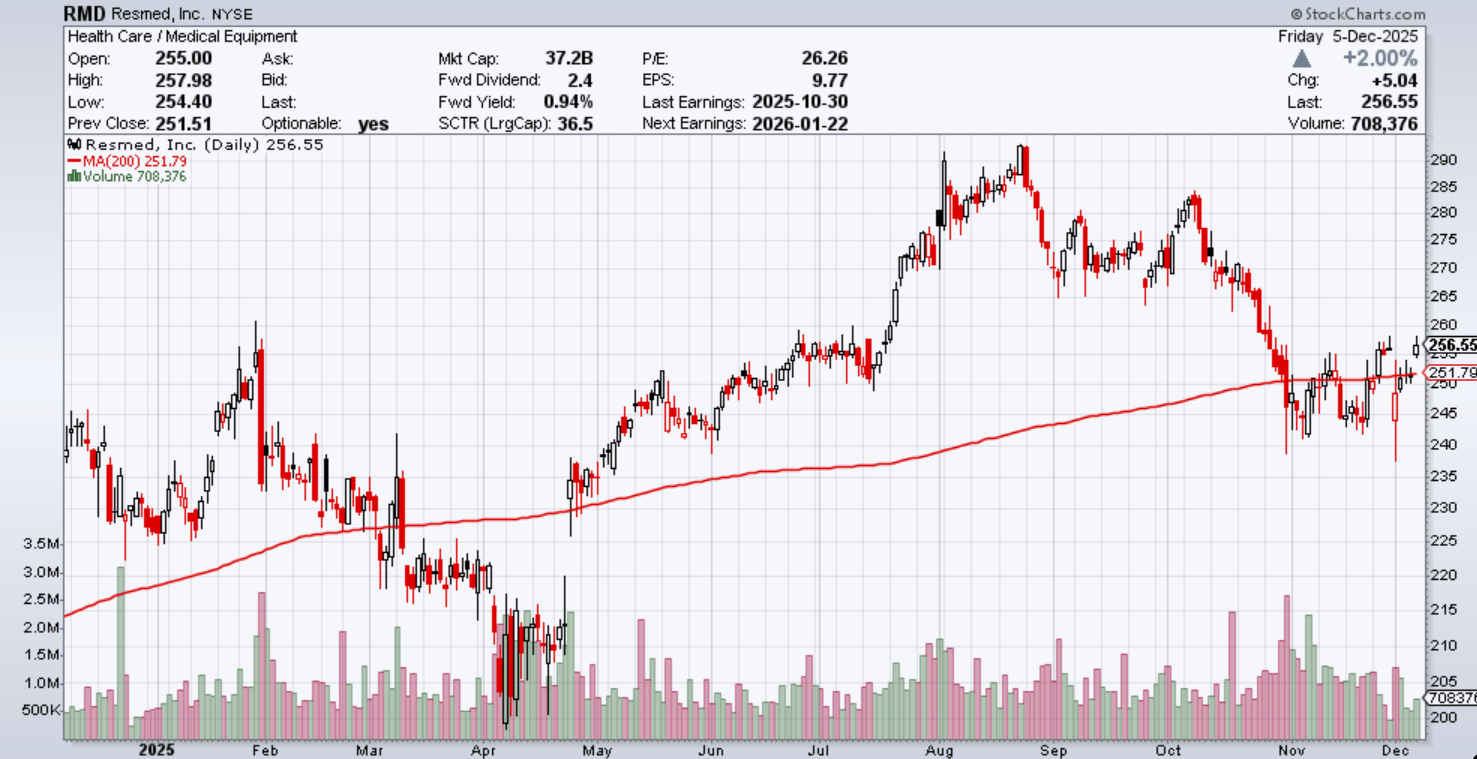

5. ResMed Inc (RMD)

The GLP-1 controversy creates an opportunity

What They Do

ResMed makes CPAP machines and masks for sleep apnea. They're the dominant player, especially since competitor Philips got banned from the US market after a massive recall. Over 936 million people globally have sleep apnea, but only about 15% use CPAP therapy. That's a huge untapped market.

What's Happening Now

This is the most controversial name on the list. The bear case is simple: GLP-1 weight loss drugs (Ozempic, Zepbound) could cure obesity-driven sleep apnea, shrinking ResMed's market.

Clinical trials showed Zepbound reduced sleep apnea severity by 50%, with 43-51% of patients achieving "disease resolution." Zepbound became the first FDA-approved drug for sleep apnea in December 2024.

On the flip side: ResMed's own 811,000-patient study shows GLP-1 users are actually 10.7 percentage points MORE likely to start CPAP therapy and show higher mask resupply rates. Why? Weight loss helps diagnose previously undetected sleep apnea. Meanwhile, Q1 FY26 revenue grew 9% and gross margins exploded to 62%—>up 280 basis points. The stock has rallied off lows and is now trading above its 200-day moving average.

The numbers: 25% ROE, 20% ROIC, net cash, trading at ~26x earnings (down from peak multiples).

Bull Case

GLP-1s may actually be a tailwind,data shows drug users MORE likely to start CPAP

Philips banned from US indefinitely, ResMed has near-monopoly

Massive untapped market: 85% of sleep apnea patients don't use CPAP

Gross margins hit 62%, pricing power is real and expanding

Bear Case

GLP-1 risk is real, 43-51% disease resolution in trials could shrink the market

Philips will eventually return to the US market

Stock has already bounced, less margin of safety than a few months ago

Insiders only selling, no buying

All five share the same DNA

Elite capital efficiency, real moats, and balance sheets that can weather a storm.

NVR

is getting cheaper for a reason—> cancellations hit 19%, orders down 16%. But mortgage rates are finally cooling (6.1-6.3%) and they're sitting on $2.2B in cash buying back stock. If housing stabilizes this has room to run.

Cintas

actually executing better than the stock suggests imo. Q1 came in at $2.72B (+8.7%), First Aid growing 14%+. Down 19% from highs but the business hasn't missed a beat.

Earnings drop December 18th, no need to over complicate a company that started making uniforms in the 1920’s

Personally, I like this trade the best. Clear risk for me below 180’s means it is not working now…

Charts and stories like this draw me in. I love clear technical consolidating bases with strong fundamentals.

WD-40

flipped the script. After that ugly Q3 (1% growth), Q4 came in at 5% with a 27% EPS beat. Margins expanding. Still not cheap at 29x, but the "stalling growth" narrative is dead.

Cal-Maine

remains the wildcard—3x earnings, zero debt, $1.25B in liquidity. If you think avian flu keeps disrupting supply, this is free money. If flock recovery accelerates, you're catching a falling knife. Even with solid balnce sheet I think this one is most speculative

ResMed

Margins exploded to 62%, P/E compressed to 26x, and the stock's already bounced above its 200 avg. The GLP-1 bull case (it's a tailwind, not a headwind) is playing out in real-time.

Not recommendations to make a trade on right now. These are Ideas I think are worth digging into and I’m trying to highlight why/the reasoning behind that.

Disclaimer: This is not financial advice. I may hold positions in some of the stocks mentioned. Always do your own research before investing.

-John