- Pivot & Flow

- Posts

- 4 minutes. Then they buy.

4 minutes. Then they buy.

That's your competition. And your edge.

Happy Sunday,

Quick question: How much time do you spend researching a stock before you buy it?

Because the average investor? Four minutes.

Let's dig in…

Not four hours. Four minutes.

That's the median time retail investors spend "researching" before they click buy, according to new data from Toomas Laaritz and Jeffrey Wurgler tracking tens of thousands of US households.

Half spend even less.

If you're reading this newsletter, you're already doing more research than 50% of the people you're competing against. Let that sink in.

Here's what those four minutes look like:

They visit Yahoo Finance 23 times a month. They check broker platforms, scan headlines, pull up charts. Sounds diligent, right?

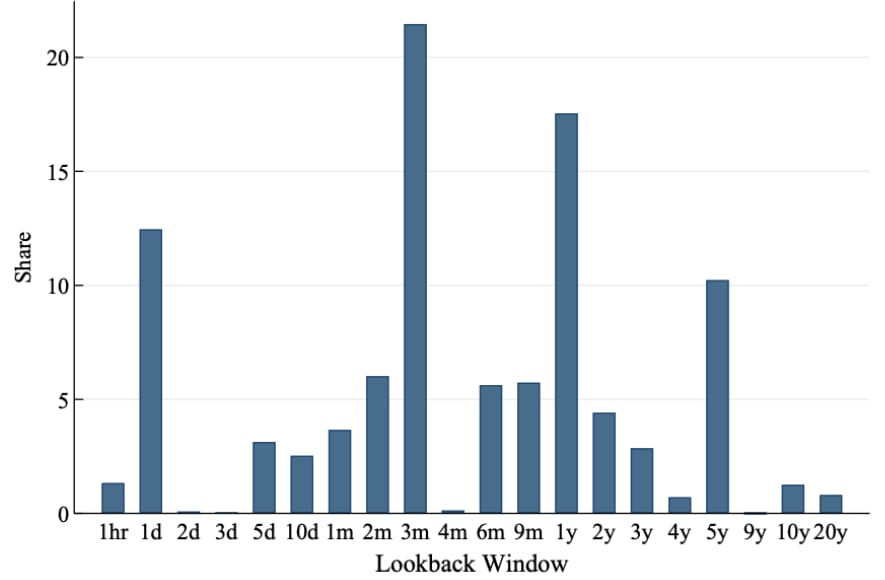

But when researchers tracked which charts they actually looked at—filtering out default views to see what lookback periods investors deliberately chose—the winner was three months.

Not annual reports. Not earnings calls. Not even analyst notes. Just three-month price charts.

Source: Laaritz and Wurgler (2025)

What does a 3month chart tell you? Whether it went up or down. That's it. Pure momentum chasing with zero context.

Now momentum can work like if you're systematically building a factor portfolio across dozens of stocks, or doing deep fundamental research and using charts to time entry.

But retail investors aren't doing either.

Today’s Sponsor

Start investing right from your phone

Jumping into the stock market might seem intimidating with all its ups and downs, but it’s actually easier than you think. Today’s online brokerages make it simple to buy and trade stocks, ETFs, and options right from your phone or laptop. Many even connect you with experts who can guide you along the way, so you don’t have to figure it all out alone. Get started by opening an account from Money’s list of the Best Online Stock Brokers and start investing with confidence today.

The average portfolio holds six to seven individual stocks representing over a third of total assets. Concentration without conviction. They're picking names they heard about and checking if they're "hot."

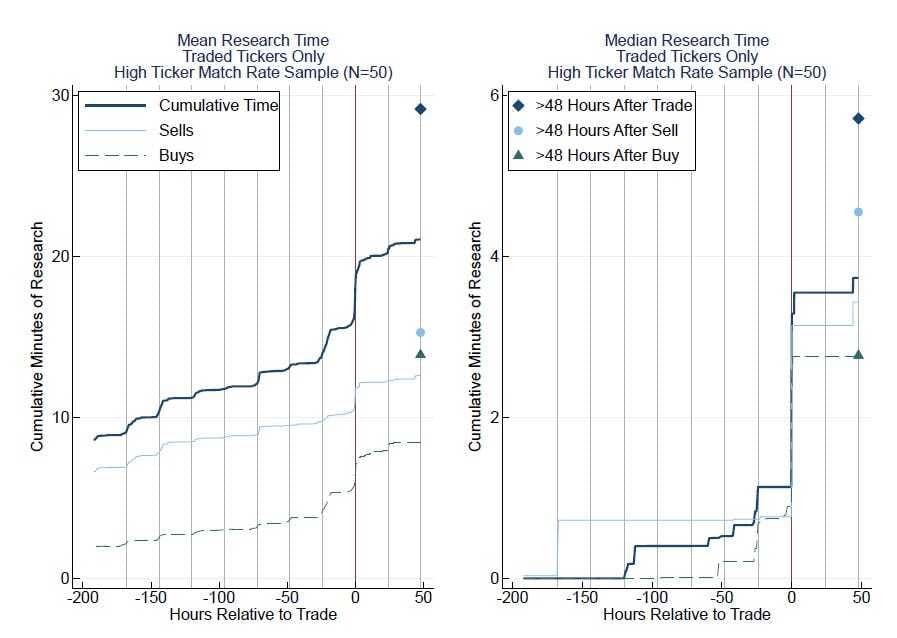

Average research time before a trade: 20 minutes, mostly in the final hours before pulling the trigger.

Median research time: under 4 minutes.

Source: Laaritz and Wurgler (2025)

Four minutes to decide where to put thousands of dollars. About as long as it took to read this far.

Then they buy. Fire and forget.

The only thing they spend more time on? Deciding when to sell.. a whopping 10 minutes on average. Because apparently watching something bleed requires deeper contemplation than buying it.

This isn't investing. This is Amazon impulse shopping with your retirement account.

So here's your edge: You're reading this newsletter. You're spending more than four minutes thinking about where your money goes. You're analyzing fundamentals, watching market structure, understanding what drives returns beyond "line go up."

The bar is lower than you think. Most people aren't doing the work. They're not your competition, they're the reason opportunity exists.

The question isn't whether you can beat the market. It's whether you're willing to do more than four minutes of work while everyone else is panic-buying whatever's trending on StockTwits/twitter/ect.

Stay Curious,

- John

P.S. - You just spent more time reading this than most investors spend researching their entire portfolio this month.

Today’s Sponsor

Crash Expert: “This Looks Like 1929” → 70,000 Hedging Here

Mark Spitznagel, who made $1B in a single day during the 2015 flash crash, warns markets are mimicking 1929. Yeah, just another oracle spouting gloom and doom, right?

Vanguard and Goldman Sachs forecast just 5% and 3% annual S&P returns respectively for the next decade (2024-2034).

Bonds? Not much better.

Enough warning signals—what’s something investors can actually do to diversify this week?

Almost no one knows this, but postwar and contemporary art appreciated 11.2% annually with near-zero correlation to equities from 1995–2024, according to Masterworks Data.

And sure… billionaires like Bezos and Gates can make headlines at auction, but what about the rest of us?

Masterworks makes it possible to invest in legendary artworks by Banksy, Basquiat, Picasso, and more – without spending millions.

23 exits. Net annualized returns like 17.6%, 17.8%, and 21.5%. $1.2 billion invested.

Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.