- Pivot & Flow

- Posts

- October 28th Market Overview

October 28th Market Overview

October 28th Market Overview (no fluff)

Happy Tuesday

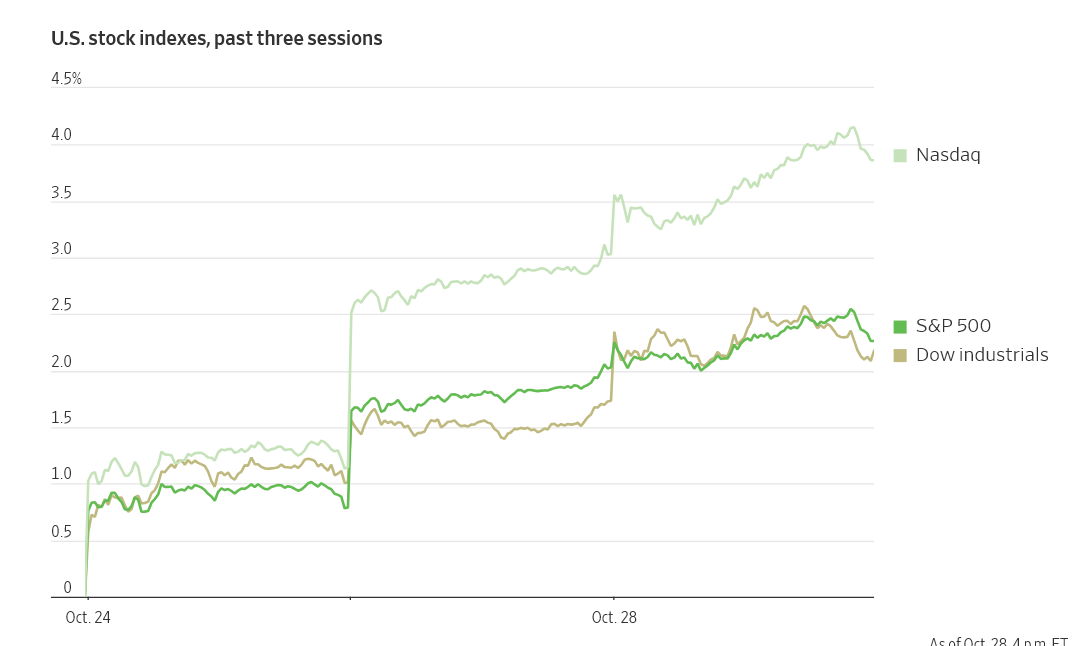

Ah, market continues its rip into new records with the S&P pushing toward 7,000.

Nvidia's selling AI's gold rush shovels, making deals across every sector. Everyone's acting like Trump and Xi already shook hands before Thursday's meeting.

We're buying both the AI boom AND a China trade deal at the same time. That's pricing perfection on two fronts that haven't fully delivered yet.

Let's dig in...

P.S. Premium subscribers locked in at the original price get every new tool I build, forever.

Announcing another tool I built tomorrow.

That grandfathered rate isn't coming back so concrats if you got in early!

Today's Big Picture

Microsoft and OpenAI Clear the Air

Microsoft will own 27% of OpenAI’s new structure with a $250 billion Azure purchase agreement locked in. The deal removes what one analyst called a “quagmire” hanging over the stock. Microsoft crossed $4 trillion in market cap today.

Nvidia Drives Markets Higher With Deal Spree

Nvidia took a $1 billion stake in Nokia for 6G work, announced a pharma supercomputing partnership with Eli Lilly, and unveiled tech linking quantum processors to AI systems. CEO Jensen Huang meets Trump tomorrow. The stock pushed toward a $5 trillion valuation.

Nuclear Gets Real Money

The U.S. government partnered with Cameco and Brookfield on an $80 billion plan to build new Westinghouse reactors. Japan separately committed up to $200 billion for nuclear projects from Westinghouse and GE Vernova. This is infrastructure spending at scale.

Market Overview

Index Performance

Stock Spotlight

Microsoft $MSFT ( ▲ 1.9% )

crossed $4 trillion in market cap after finalizing its OpenAI ownership structure. The company reports earnings Wednesday.

Apple $AAPL ( ▲ 0.8% )

briefly crossed $4 trillion but gave back most gains by close.

PayPal $PYPL ( ▲ 1.3% )

became the first payment wallet integrated into ChatGPT. Users will be able to shop and checkout directly in the platform starting next year. Third quarter earnings crushed expectations.

Amazon $AMZN ( ▼ 5.56% )

cutting 14,000 corporate jobs immediately with total cuts expected to reach 30,000. Leadership says the company is still bloated from pandemic hiring. Reports Thursday.

Big Name Updates

Cameco $CCJ ( ▲ 3.98% )

rallied on the nuclear partnership announcement. The company will work with Brookfield and Westinghouse on new U.S. reactors.

UPS $UPS ( ▲ 0.68% )

beat estimates and raised guidance after cutting 34,000 jobs. That's more than the 20,000 previously announced.

Nvidia $NVDA ( ▲ 7.87% )

closed above $200 for the first time (split adjusted) The company announced partnerships spanning telecom, pharma, and quantum computing during its conference in Washington.

UnitedHealth $UNH ( ▲ 3.02% )

beat lowered expectations and raised full-year guidance despite operating earnings being cut in half year over year.

Other Notable Company News

Royal Caribbean $RCL ( ▲ 6.72% )

dropped despite beating earnings. The revenue miss and soft guidance disappointed investors.

NextEra Energy $NEE ( ▲ 0.29% )

is partnering with Google to restart a nuclear plant in Iowa under a 25-year power agreement.

Whirlpool $WHR ( ▲ 1.68% )

says its domestic manufacturing advantage is finally paying off as tariffs hit foreign competitors harder.

JetBlue $JBLU ( ▲ 5.3% )

posted a smaller loss than expected helped by cutting unprofitable routes.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year auction went fine. Yields barely moved on the $39 billion sale. The dollar hit its highest level since August. Tomorrow: $22 billion 30-year auction before the Fed announces.

Policy Watch

Fed

The Federal Reserve is expected to cut rates by 25 basis points Wednesday. The real focus is Powell's press conference and whether he signals another December cut. I think he stays noncommittal.

Trade

WSJ reports the U.S. would cut tariffs on Chinese goods by up to 10 points if China cracks down on fentanyl chemical exports

That drops the effective rate from 55% to 45%

Trump meets Xi Thursday

Markets already pricing in a deal

Government Shutdown

Federal workers including air traffic controllers miss their first full paycheck today. Active duty military face the same Friday. No resolution in sight.

Japan Partnership

Trump and Prime Minister Takaichi announced Toyota will invest $10 billion in U.S. plants

Japan laid out up to $400 billion in potential investments across energy, AI, and critical minerals

Commerce Secretary Lutnick signed $490 billion in deals

Today’s Sponsor

Final Days to Invest: Every City’s a Potential Surf Destination

Topgolf revolutionized golf by turning it into a social, tech-driven game for anyone. And they’ve made billions in annual revenue doing it. Surf Lakes is applying that same model to surfing, and investors can still join them until 10/30 at 11:59 PM PT.

Their patented tech creates 2,000 ocean-quality rides per hour, anywhere in the world, across all skill levels.

It’s a $65B surf tourism market opportunity. They’ve already sold 8 tech licenses, plus their own commercial parks are underway.

3x world champ Tom Curren and surf icon Mark Occhilupo have joined as ambassadors and shareholders. Even actor Chris Hemsworth has praised Surf Lakes.

You have until October 30th at 11:59 PM PT to invest in Surf Lakes.

This is a paid advertisement for Surf Lakes’ Regulation CF offering. Please read the offering circular at https://invest.surflakes.com

What to Watch

Fed Decision Wednesday

The 25 basis point cut is baked in. Watch Powell's language on December and the shutdown's impact on data. If he sounds dovish, tech likely extends.

Trump-Xi Meeting Thursday

The market has already moved on trade deal hopes. If nothing concrete emerges, expect giveback. Any progress on fentanyl and tariffs counts as a win.

Big Tech Earnings

Microsoft reports Wednesday after the close, then Amazon and Apple Thursday. These five companies are roughly a quarter of the S&P 500. So far 83% of companies are beating estimates this season.

Gold Testing $4,000

Gold fell below $4,000 today for the first time since early October. Trade optimism is pulling money out of safe havens. Watching whether this is profit-taking or something bigger.

ADP Weekly Jobs Data

ADP now reports weekly employment figures. Latest shows 14,250 private jobs added per week through mid-October. Fills the void from the shutdown killing official data.

Thanks for reading 🙂

- John

Today’s Sponsor

Free email without sacrificing your privacy

Gmail tracks you. Proton doesn’t. Get private email that puts your data — and your privacy — first.

Note: This newsletter is intended for informational purposes only.