- Pivot & Flow

- Posts

- October 15th Market Overview

October 15th Market Overview

October 15th Market Overview (no fluff)

Happy Wednesday

Some reoccurring patterns I’m noticing over and over again this year.

-Ai deals and revenue aren’t going anywhere soon

-Private equity is getting more and more involved with public equity

-No one wants to sit in U.S. cash, money is pouring into small caps not just “safe-haven” typicals like gold

Let's dig in...

Today's Big Picture

Big Banks Beat on Trading and Dealmaking

Bank of America $BAC and Morgan Stanley $MS both beat earnings. Morgan Stanley's trading revenue was strong, driven by hedge funds borrowing to buy more stocks. Investment banking is heating back up as deals return. Bank CEOs say the consumer is still strong but they're getting uneasy about what's next.BlackRock Buys $40 Billion in Data Centers for AI

BlackRock, Microsoft, and Nvidia are buying Aligned Data Centers for $40 billion. First deal from BlackRock's AI infrastructure fund, which is targeting $100 billion total. They plan to double Aligned's data center footprint.Bessent Publicly Calls Out Chinese Negotiator by Name

Treasury Secretary Bessent broke protocol and publicly named Chinese Vice Minister Li Chenggang as "disrespectful" after Li showed up uninvited in Washington.

According to Bessent, after four productive negotiation rounds, Li arrived with a threat: "China will cause global chaos if the port shipping fees go through." Bessent called it coercion, not negotiation.

Market Overview

Index Performance

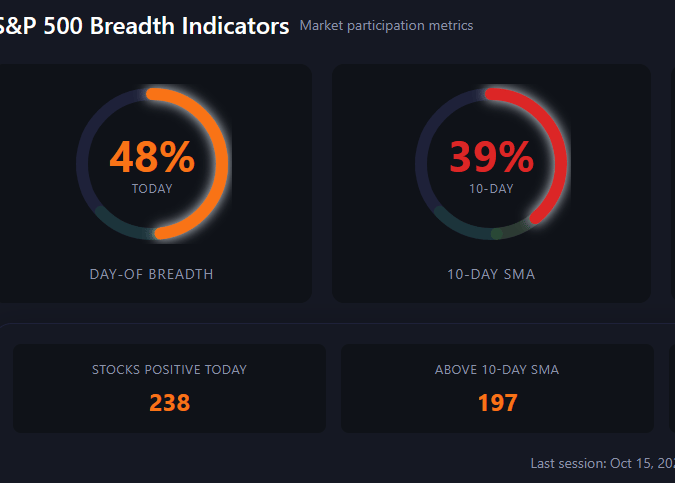

Noting today there really wasn’t broad participation going green, a lot of stocks are still under there 10 day avg.

This is all while small caps are outpacing large caps on the week.

Upgrade to premium and get → Market Health dashboard

Stock Spotlight

Bunge Global $BG ( ▲ 1.03% )

was the top S&P 500 gainer after Trump threatened to ban used cooking oil imports from China. Bunge produces soybean oil, which competes with cheaper Chinese imports. Trump said it's retaliation for China not buying U.S. soybeans.

Progressive $PGR ( ▲ 0.91% )

was the biggest S&P 500 decliner after missing earnings estimates. Allstate $ALL and Travelers $TRV also fell.

ASML $ASML ( ▼ 0.9% )

rose on better-than-expected orders and said 2026 sales will top 2025. CEO said AI chip demand isn't slowing.

PNC Financial $PNC ( ▼ 4.7% )

fell on soft fourth-quarter guidance despite beating third-quarter estimates. Higher expenses. Shares are now down for the year while most other big banks are higher.

Big Name Updates

Walmart $WMT ( ▲ 2.84% )

hit a 52-week high on its OpenAI partnership allowing purchases through ChatGPT. No other retailer has this capability in ChatGPT. Citi kept it as their top retail pick.

Apple $AAPL ( ▼ 3.21% )

CEO Tim Cook said he'll boost China investment despite tariff uncertainty. Separately, iPhone 17 wait times are trending down across key markets.

Alphabet $GOOGL ( ▲ 1.43% )

will launch Waymo driverless ride-hailing in London next year. Partnering with Uber-backed Moove to manage the fleet.

Other Notable Company News

First Solar $FSLR ( ▼ 1.45% )

got a BofA price target increase to $254 from $209 on expanded U.S. capacity and pricing power.

Whirlpool $WHR ( ▲ 0.29% )

will spend $300 million updating two Ohio factories, creating up to 600 jobs.

Archer-Daniels-Midland $ADM ( ▲ 2.4% )

gained on the cooking oil news.

Papa John's $PZZA ( ▲ 1.42% )

rose on reports Apollo Global offered to take it private at $64 per share.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year yield fell to 4.01. The 10-year auction went fine despite the shutdown. Tomorrow: $22 billion 30-year bond auction.

Policy Watch

Fed

Market expects quarter-point cuts at both remaining meetings this year. Powell cited job market weakness. Bessent narrowed the Fed chair candidate list to five finalists and will present Trump with three to four names after Thanksgiving.

Government Shutdown

Week three. Bessent estimates it's costing $15 billion per day. Economic data releases remain halted.

Fiscal & Trade

Bessent said the administration will set price floors across industries to compete with China's industrial policy. Wouldn't be surprised if the U.S. takes stakes in companies.

Trump threatened to ban Chinese cooking oil imports in retaliation for Beijing not buying U.S. soybeans. Also threatened an additional 100% tariff on Chinese goods after Beijing's rare earth export restrictions. Bessent said the U.S. has more powerful leverage - like aircraft engines China needs.

Farmer support package coming after the government reopens. Hassett called it "clever and generous" but gave no details.

International

U.S. close to finalizing a deal with South Korea

Trade talks with Canada are "back on track"

U.S. will tariff China for buying Russian oil if Europe joins

Today’s Sponsor

This Technology Makes Every City a Potential Surf Destination

Topgolf revolutionized golf by turning it into a social, tech-driven game for anyone. And they’ve made billions in annual revenue doing it. Surf Lakes is applying that same model to surfing. Their patented tech creates 2,000 ocean-quality rides per hour, anywhere in the world, across all skill levels.

Surf tourism is a $65B global industry, yet fewer than 1% of people live near real waves. Licenses sold across the U.S. and Australia, with plans for a first commercial park in the works.

3x world champ Tom Curren and surf icon Mark Occhilupo have joined as ambassadors and shareholders. Even actor Chris Hemsworth has praised Surf Lakes.

You have until October 30th at 11:59 PM PT to invest in Surf Lakes.

This is a paid advertisement for Surf Lakes’ Regulation CF offering. Please read the offering circular at https://invest.surflakes.com

What To Watch

Travelers Earnings

Travelers $TRV ( ▲ 0.78% ) reports Thursday morning after Progressive missed today. The question: is this a Progressive problem or an insurance sector problem?

Trump-Xi Meeting End of Month

Trump and Xi meet in South Korea October 31-November 1. JPMorgan thinks this is where both sides back off the 100% tariffs. Until then, expect more threats.

Economic Data Blackout

Consumer inflation data pushed to October 24. Retail sales and wholesale inflation stuck indefinitely. We're trading blind on the actual economy.

Thanks for reading 🙂

- John

Note: This newsletter is intended for informational purposes only.