- Pivot & Flow

- Posts

- October 14th Market Overview

October 14th Market Overview

October 14th Market Overview (no fluff)

Happy Tuesday

Markets fell hard, then recovered harder. Not on earnings or economic data - on a single comment that Trump and Xi are still talking. When one TV appearance can swing the Dow 1,000 points, we're trading sentiment, not fundamentals.

Banks posted great earnings. Nobody cared.

P.S. looks like markets getting a bit of a kick end of day because of a Trump Soybean tweet. This is breaking and came out as I was finishing up here.

Let's dig in...

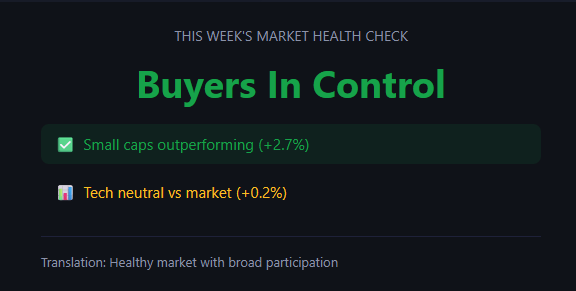

Big signal in the market health dashboard today. Small caps are recovering faster then I expected.

Today's Big Picture

1. Markets Swing 1,000 Points on Trade Headlines

China sanctioned a Korean shipbuilder's US operations this morning. Dow dropped 615 points. Then the US Trade Rep said on CNBC that Trump and Xi are still meeting later this month. Dow finished up 400. That's a 1,000-point swing on one TV soundbite. We're trading headlines, not fundamentals.

2. Banks Beat Earnings But Dimon Sees Cracks

JPMorgan $JPM, Goldman $GS, and Wells Fargo $WFC crushed it on trading and banking fees. But Dimon pointed to two auto lender bankruptcies and said "when you see one cockroach, there are probably more."

Translation: after 14 years of easy money, companies borrowed too much. If the economy slows, defaults will pile up.

3. Fed Signals End of Balance Sheet Runoff

Powell said the Fed will soon stop shrinking its bond holdings. Banks are getting tight on cash. This isn't a rate cut signal. It just means one form of tightening is ending because they've drained enough liquidity from the system.

Market Overview

Index Performance

Stock Spotlight

Oracle $ORCL ( ▼ 3.27% )

will deploy 50,000 AMD $AMD GPUs starting in the second half of 2026. This directly challenges Nvidia’s dominance in AI cloud infrastructure. Wolfe Research upgraded AMD to Outperform with a $300 target on the OpenAI partnership and rising server demand.

Walmart $WMT ( ▲ 2.84% )

announced a partnership with OpenAI to let shoppers buy products directly within ChatGPT. This signals that online shopping is about to fundamentally change.

Nvidia $NVDA ( ▼ 4.17% )

started shipping its new DGX Spark desktop AI supercomputer with 1 petaflop of performance. CEO Jensen Huang personally delivered the first unit to Elon Musk at SpaceX’s Starbase in Texas.

Big Name Updates

Broadcom $AVGO ( ▼ 0.67% )

is launching Thor Ultra, a new networking chip that doubles bandwidth to scale up AI data center networks. The chip competes directly with Nvidia’s networking interfaces as Broadcom targets a $60-90 billion AI market by 2027.

Google $GOOGL ( ▲ 1.43% )

plans to invest $15 billion in an India AI hub.

General Motors $GM ( ▼ 2.58% )

will take a $1.6 billion charge in Q3 to realign its EV production strategy. The charge includes $1.2 billion in non-cash impairments as GM reassesses its EV investments following US tax credit cuts.

Other Notable Company News

First Solar $FSLR ( ▼ 1.45% )

got a Citi price target raise to a street high of $300 from $198. Citi expects third-quarter earnings to beat on stronger pricing and robust US bookings.

Johnson & Johnson $JNJ ( ▲ 2.04% )

beat third-quarter expectations and announced it will separate its orthopedics business within two years. The company also raised its annual sales outlook.

Domino’s Pizza $DPZ ( ▲ 0.81% )

beat expectations with US same-store sales growth. CEO Russell Weiner said a $9.99 pizza deal is helping capture business from competitors and they’re extending it.

Novavax $NVAX ( ▼ 9.38% )

is facing pressure from Shah Capital, its second-largest shareholder, urging the board to pursue a sale.

Disney $DIS ( ▲ 0.46% )

has considered naming Dana Walden and Josh D’Amaro as co-CEOs to replace Bob Iger, with an announcement expected in early 2026.

BlackRock $BLK ( ▼ 2.48% )

CEO estimates more than $4.5 trillion is currently held in digital wallets across crypto, stablecoins, and tokenized assets. He expects the market to expand rapidly.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year Treasury held steady despite shutdown uncertainty. The VIX spiked above 22 intraday - a four-month high - before settling under 20. That tells you investors bought protection this morning then unwound it after Greer's trade comments

Policy Watch

Fed

Powell said the Fed will stop shrinking its balance sheet soon because banks are running low on cash. He also pushed back on Senator Ted Cruz who wants to stop paying interest on bank reserves. Powell's response: that's literally how the Fed controls rates.

On the economy, nothing's changed since September. But the shutdown is blocking data. If it continues, they won't have October jobs numbers for their next meeting.

Government Shutdown

Citi expects this to drag into November. Why? Military pay and welfare checks are still going out. No pain means no pressure on Congress to fix it.

Only confirmed data release: CPI next week. They called workers back just to produce that report.

Trade

Three things happened today:

China defended its rare earth controls and said they warned the US in advance

Treasury Secretary Bessent said China's in a depression and trying to drag everyone else down

USTR Greer confirmed Trump and Xi are still meeting this month

That last one is what turned the market around.

International

Trump on Argentina's election: "If he loses, we will not be generous with Argentina." Their stock market dropped. The US has been buying pesos to prop up the current government.

Today’s Sponsor

Thousands of Investors Are Backing This Cocktail Bar’s Major Expansion

On New Year’s Eve in 2006, 24-year-old David Kaplan opened the first Death & Co as a “blink and you’ll miss it” cocktail bar in Manhattan’s East Village.

The bars welcome more than 10,000 visitors each week and the company is on track to do $20M this year.

No surprise, considering they’re listed in “The World’s 50 Best Bars” and their cocktail book was the first drinks book to ever win the James Beard Award for “Book of the Year.”

Building off their iconic Death & Co brand, they have their sights set on a new frontier: building a global hospitality business.

With the company projecting 5.5X revenue growth in just four years, scaling 200% faster than leading hospitality brands, investors see a unique opportunity.

That’s why 3,000+ people have invested in Death & Co already. But the investment opportunity ends on Oct. 30.

This is a paid advertisement for Death & Company’s Regulation A offering. Past performance is not indicative of future results. Please read the offering circular at invest.deathandcompany.com.

What To Watch

CPI Report Next Week

First major inflation data since the shutdown. The government specifically called workers back to produce this report. If it comes in hot, rate cut expectations get pushed back. If it's cool, the Fed has room to ease. This will move the market.

Trump-Xi Meeting Timing

Greer confirmed it's still happening but gave no date. Every trade headline between now and then will swing markets. We just saw a 1,000-point intraday move on a single TV comment. Stay alert.

Credit Cracks Starting to Show

Dimon pointed to two auto lender bankruptcies as warning signs after 14 years of loose lending. If he's right, more blowups are coming. Watch high-yield spreads and subprime auto/consumer credit for stress signals.

Gold at $4,166

Another all-time high. Citadel's Ken Griffin nailed it: investors now see gold as the safe haven the dollar used to be. When gold and stocks both rally together, something structural is shifting in how people view currency risk and this is a theme I’ve been trying to highlight the past 3 weeks.

Thanks for reading 🙂

- John

Note: This newsletter is intended for informational purposes only.