- Pivot & Flow

- Posts

- July 22nd Market Overview

July 22nd Market Overview

July 22nd Market Overview (no fluff)

Happy Monday

Markets taking a breather after yesterday's records, which makes sense given we're finally seeing tariffs move from theory to reality → General Motors just took a $1.1 billion hit. Bessent's heading to Stockholm next week to likely extend the China deadline, so concrete costs are meeting concrete diplomacy.

Let's dig in...

Summary

Tariffs Hit Corporate Bottom Lines

General Motors $GM ( ▲ 1.13% ) delivered the first major example of tariff reality with $1.1 billion in quarterly damage and warnings that Q3 will be worse. Real companies are taking real hits that flow straight to shareholders.

Trade Momentum Building

Trump announced a Philippines trade deal while Bessent’s Stockholm meetings with Chinese officials next week signal likely extension of the August 12 deadline. Bilateral deals are happening, but China remains in negotiation.

Earnings Strong but Selectivity Rising

82% of S&P 500 companies beat estimates this season, yet markets stayed flat near records. Investors want proof companies can handle tariff costs before paying premiums. Alphabet $GOOGL and Tesla $TSLA report Wednesday.

AI Infrastructure Reality Check

SoftBank and OpenAI scaled back their $500 billion AI project, sending chip stocks lower. Is massive AI buildout hitting practical limits or just execution hiccups?

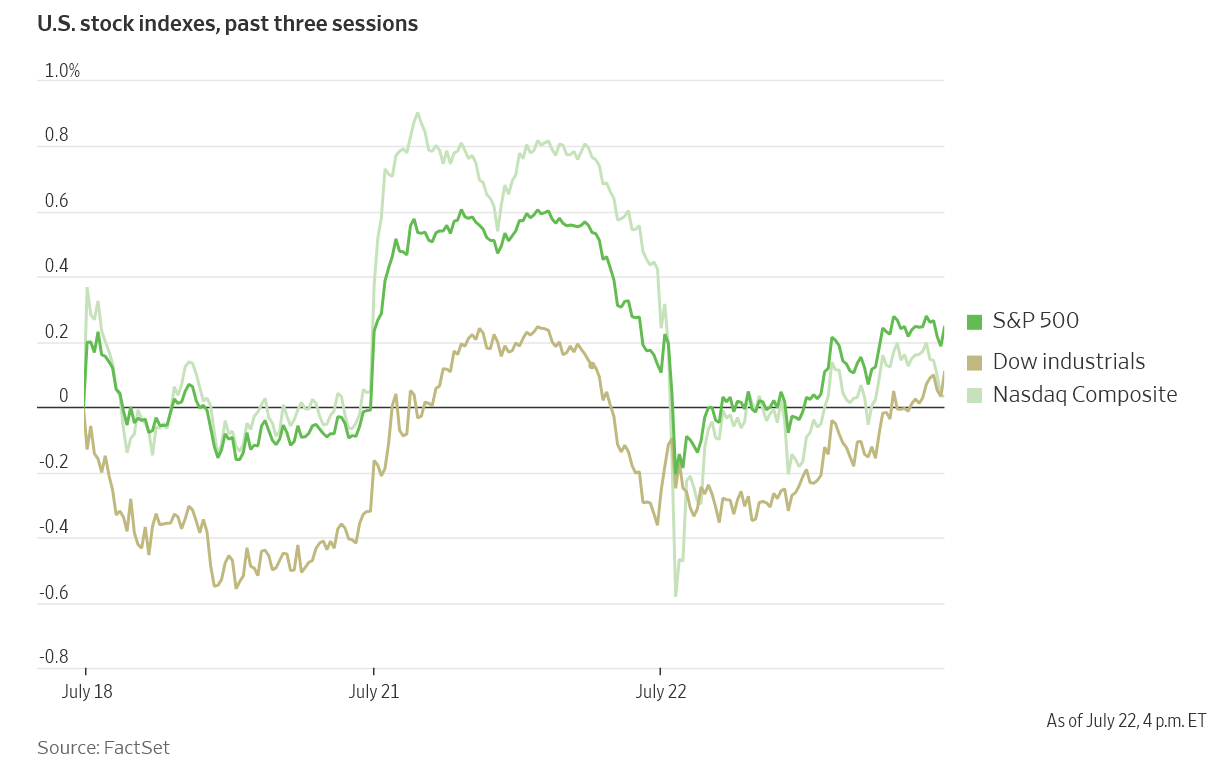

Market Overview

U.S. Stock Indexes, This Week so Far

Stock Spotlight

General Motors $GM ( ▲ 1.13% ) provided the day’s most important lesson. Despite beating EPS estimates, the $1.1 billion tariff hit crushed North America margins from 10.9% to 6.1%. Management warned Q3 impact will be worse. This is tariff policy in real corporate earnings.

Lockheed Martin $LMT ( ▲ 2.36% ) hit new 52-week lows after missing revenue by $400 million and reporting $1.6 billion in losses on legacy defense programs. Management cited “new developments” forcing program re-evaluations. Meanwhile, Northrop Grumman $NOC hit all-time highs, proving execution beats sector trends in defense.

Philip Morris $PM ( ▲ 0.45% ) beat estimates despite revenue shortfall. Smoke-free products now represent 41% of total revenue, with IQOS generating over $3 billion quarterly and ZYN pouch volumes jumping in the U.S. Marlboro hit highest market share since 2008.

Big Name Updates

Alphabet $GOOGL ( ▼ 2.53% ) received an outperform reiteration ahead of Wednesday earnings. Analysts noted unexpected Vertex/GCP momentum and a “buy the traffic dip” mentality from advertisers dealing with reduced organic traffic from AI search changes.

Apple $AAPL ( ▲ 0.8% ) faces headwinds per UBS analysis showing June iPhone sell-through declined after two strong months driven by tariff price increase fears. The firm expects September weakness from prior demand pull-forward.

Tesla $TSLA ( ▲ 3.5% ) opened its 1950s-style Diner + Drive-In in Los Angeles, seven years after Musk first teased it. More importantly, the company reports earnings Wednesday as investors seek delivery and margin clarity.

Charles Schwab $SCHW ( ▲ 3.02% ) cut guidance, lowering full-year EPS expectations as management cited demand weakness through June with no near-term catalysts visible.

Other Notable Company News

Oracle $ORCL ( ▲ 4.65% ) announced a partnership to build 4.5 gigawatts of additional Stargate data center capacity and will reportedly supply OpenAI with 2 million AI chips. The move positions Oracle as a key AI infrastructure player beyond traditional cloud giants.

Kohl’s $KSS ( ▲ 4.4% ) became the day’s meme stock sensation with wild trading that saw shares more than double before giving back gains. Trading was briefly halted as retail traders chased another squeeze candidate.

Coca-Cola $KO ( ▲ 0.66% ) confirmed plans to launch a U.S. cane sugar version this fall as a new product line, not replacing the current corn syrup version. The company beat EPS estimates but missed revenue expectations.

MicroStrategy $MSTR ( ▲ 26.12% ) announced an IPO of 5 million shares with proceeds earmarked for Bitcoin acquisition, demonstrating continued corporate crypto adoption.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year Treasury yield dropped to 4.342% as tariff concerns drove modest flight-to-quality buying. The move reflects growing recognition that trade policy uncertainty could slow growth.

• Gold hit a record high at $3,439.20 per troy ounce as the dollar weakened

• Bond market looks increasingly attractive relative to expensive equities

• Wells Fargo Investment Institute notes stocks appear pricey versus fixed income

Policy Watch

Treasury Secretary Bessent called for a review of the “entire Federal Reserve institution” but softened his stance, saying Fed Chair Jerome Powell should finish his term if he wants to. Fed Governor Michelle Bowman defended central bank independence while acknowledging transparency obligations.

• Fed enters blackout period ahead of July 29-30 policy meeting

• Political pressure intensifying as Trump administration questions Fed renovation costs

• Trade policy momentum building with Philippines deal and planned China meetings

The Philippines trade pact features 19% tariffs on their imports in exchange for zero tariffs on U.S. exports, showing the administration’s bilateral approach gaining traction.

Today’s Sponsor

Hydrated Skin. Deeper Sleep. One Daily Ritual!

Hydration Wasn’t Working—Until This

I thought I had hydration figured out—plenty of water, clean skincare, and electrolytes. But my skin was still dry, my energy dipped midday, and sleep? Unpredictable.

Then I found Pique’s Deep Hydration Protocol—a two-step, 24-hour electrolyte ritual that supports your skin, nervous system, and cellular function from morning to night.

☀️ B·T Fountain hydrates, smooths skin, and powers energy with ceramides, hyaluronic acid, and trace minerals.

🌙 R·E Fountain calms the nervous system and promotes deep sleep with bioavailable magnesium and real lemon.

In a week, I felt better. In a month, I was glowing.

✔️ Clinically proven skin actives

✔️ Deep hydration + clarity without sugar or fillers

✔️ Truly clean, spa-grade ingredients

Now I feel balanced, rested, and radiant—every single day.

Start your ritual with 20% off for life + a free gift:

What to Watch

Magnificent Seven Earnings Begin

Alphabet and Tesla report Wednesday, kicking off results from megacap tech companies expected to drive earnings growth this season. Focus on AI infrastructure spending and demand commentary.

China Trade Extension Decision

Bessent’s Stockholm meetings with Chinese officials Monday-Tuesday next week could determine if the August 12 deadline gets extended. His “very good place” comment has markets cautiously optimistic.

Corporate Tariff Quantification

With General Motors $GM showing $1.1 billion quarterly impact, watch other industrials and automakers quantify their tariff exposure in upcoming earnings. This data helps identify which sectors face greatest headwinds.

AI Infrastructure Reality

SoftBank and OpenAI scaling back their $500 billion project raises questions about buildout pace versus ambitious headlines. Monitor cloud provider and chip company commentary about capital deployment realities.

Thanks for reading 🙂

- John

Note: This newsletter is intended for informational purposes only.