- Pivot & Flow

- Posts

- July 21st Market Overview

July 21st Market Overview

July 21st Market Overview (no fluff)

Happy Monday

Records on a Monday? I'll take it. Verizon beat and 85% of companies are topping estimates so far. Maybe this earnings season has legs after all.

Let's dig in...

Summary

Earnings Season Delivers

Both indexes hit fresh records as second-quarter results accelerated to 5% year-over-year growth from 4% last week. Of the 62 S&P 500 companies reporting, 85% beat estimates by an average of 8%. This breadth shows corporate America is navigating uncertainty better than feared.

Telecom Shows Strength

Verizon $VZ ( ▼ 1.68% ) led after beating both lines and raising full-year guidance. When boring telecom stocks deliver like this, it signals broad earnings health beyond the usual tech suspects.

Tariff Deadline Set, Market Shrugs

Commerce Secretary Lutnick confirmed August 1st as the “hard deadline” for new tariffs, removing timing uncertainty. The $VIX ( ▼ 20.03% ) stayed calm, suggesting traders expect last-minute deals or believe the impact is priced in.

AI Talent War Intensifies

Meta $META ( ▼ 1.31% ) gained on reports Zuckerberg offered $300 million packages to poach OpenAI talent. This validates the massive infrastructure spending across big tech and shows the competition involves real money.

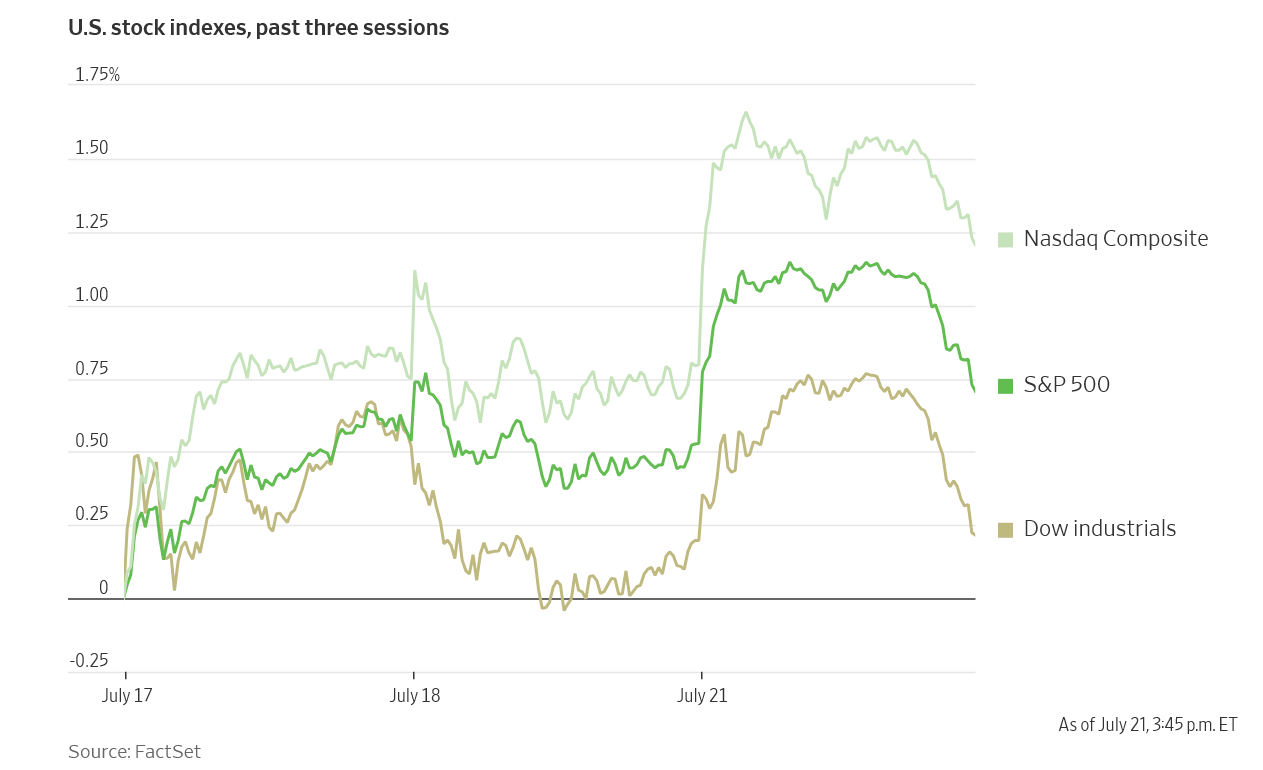

Market Overview

U.S. Stock Indexes, This Week so Far

Stock Spotlight

Invesco $IVZ ( ▲ 4.08% ) caught fire after TD Cowen upgraded to buy. The catalyst is converting the massive QQQ fund from a Unit Investment Trust to an ETF structure, which should boost flows and add roughly $100 million in annual profits.

Coinbase $COIN ( ▲ 13.0% ) got a massive price target boost to $500 from $292 at Cantor Fitzgerald. The firm believes trading volumes will climb with Bitcoin hitting fresh highs, and the market isn’t pricing in the full Base opportunity.

Sarepta Therapeutics $SRPT ( ▲ 8.63% ) continued sliding as multiple analysts downgraded following patient deaths. Needham said they’re “throwing in the towel” while Leerink cited “all credibility lost” - harsh words that matter in biotech.

Big Name Updates

Alphabet $GOOGL ( ▼ 2.53% ) climbed ahead of Wednesday earnings with Morgan Stanley lifting its target to $205. The firm wants to see profitable search growth and more disclosure on GenAI monetization across YouTube and Google Cloud.

Amazon $AMZN ( ▼ 5.56% ) faced scrutiny from a Wall Street Journal analysis showing price increases on hundreds of essential goods despite previous pledges. Baird still raised its target to $244 on cloud strength.

Tesla $TSLA ( ▲ 3.5% ) faces headwinds heading into Wednesday’s report. Bank of America warned that Chinese battery exposure creates meaningful tariff risk despite U.S. vehicle production.

Meta $META ( ▼ 1.31% ) got a price target boost to $750 from Morgan Stanley, who praised the company’s machine learning-driven growth engine that continuously improves engagement and monetization.

Other Notable Company News

Stellantis $STLA ( ▼ 23.69% ) warned of a €2.3 billion first-half loss, releasing early guidance because results were tracking worse than expected. The Jeep maker cited a $350 million tariff bill as a key factor.

Dollar Tree $DLTR ( ▲ 3.54% ) gained after Barclays upgraded to overweight. The firm sees clean growth momentum through fiscal 2025, helped by competitor store closures creating market share opportunities.

Target $TGT ( ▲ 4.24% ) fell after Barclays downgraded to underweight, warning that sales will continue underperforming without major strategic changes.

Alaska Airlines $ALK ( ▲ 7.58% ) recovered from Sunday’s system-wide IT outage that grounded all flights. The company worked through the night to restore operations.

Biogen $BIIB ( ▲ 8.54% ) announced a $2 billion investment to expand North Carolina manufacturing, focusing on antisense drug capabilities and AI-driven automation.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year Treasury yield held steady at 4.375% despite earnings optimism. Treasury Secretary Bessent provided a dovish tilt, suggesting rate cuts could be appropriate if inflation stays low, which would help unlock mortgage markets. Bond traders aren’t panicking about earnings strength yet.

Policy Watch

Washington confirmed August 1st as the tariff deadline while Brussels explores countermeasures but still wants to negotiate. The European Union is preparing a “wider set of possible counter-measures” according to diplomats.

• China talks are planned for the near future, with overcapacity expected to dominate discussions

• In Japan, the ruling LDP-Komeito coalition lost its upper house majority for the first time since 1955

• Russian precious metals exports to China hit $1 billion in the first half, up 80% year-over-year

Today’s Sponsor

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for high-net-worth entrepreneurs, executives, and professionals across multiple industries. No membership fees.

Connect with primarily self-made, 30-55-year-olds ($5M-$100M net worth) in confidential discussions, peer advisory groups, and live meetups.

Access curated alternative investments like private equity and private credit. With $100M+ invested annually, leverage collective expertise and scale to capture unique opportunities.

What to Watch

Wednesday’s Magnificent Seven Test

Alphabet $GOOGL and Tesla $TSLA earnings will determine if mega-cap leadership can continue. Google's GenAI monetization details matter more than revenue beats, while Tesla's tariff impact guidance could set the tone for manufacturing stocks.

Earnings Breadth Expansion

With 85% beat rates so far, watch whether momentum continues as more cyclical names report. Consumer discretionary and industrial results will reveal how tariff uncertainty affects real business decisions beyond earnings calls.

Bond Market Breaking Point

If earnings strength continues without Fed dovishness, watch for Treasury selling that could pressure the 4.375% yield level. Rising rates would test whether equity valuations can handle higher discount rates.

EU-US Trade Escalation

The European Union's preparation of countermeasures suggests they’re done being patient. Any rhetoric escalation before August 1st could spark volatility, particularly in export-heavy sectors like industrials and materials.

Thanks for reading 🙂

- John

Note: This newsletter is intended for informational purposes only.