- Pivot & Flow

- Posts

- July 17th Market Overview

July 17th Market Overview

July 17th Market Overview (no fluff)

In partnership with

Happy Thursday.

Odd day.

Sitting here writing this on a wawa gas station sidewalk hiding from rain trying to get this out before 4:20 on shotty wifi. Apologize in advanced if some normal stuff is missing or we don’t go as much in depth as usual. Things will be back to normal tmmrw. Rain or shine or sitting on a sidewalk on a country road gas station. I’m here writing everday (pinky swear)

Record highs today as both the S&P 500 and Nasdaq hit fresh all-time peaks, and honestly, the data backed it up. June retail sales completely reversed May's decline, jobless claims keep falling, and earnings are beating at an 88% clip versus the usual 75%.

P.S. Zillow’s co-founder has started a new company calling it a “big new idea” in the real estate space. Check it out!

Let's dig in...

Market Summary

Record highs driven by economic strength

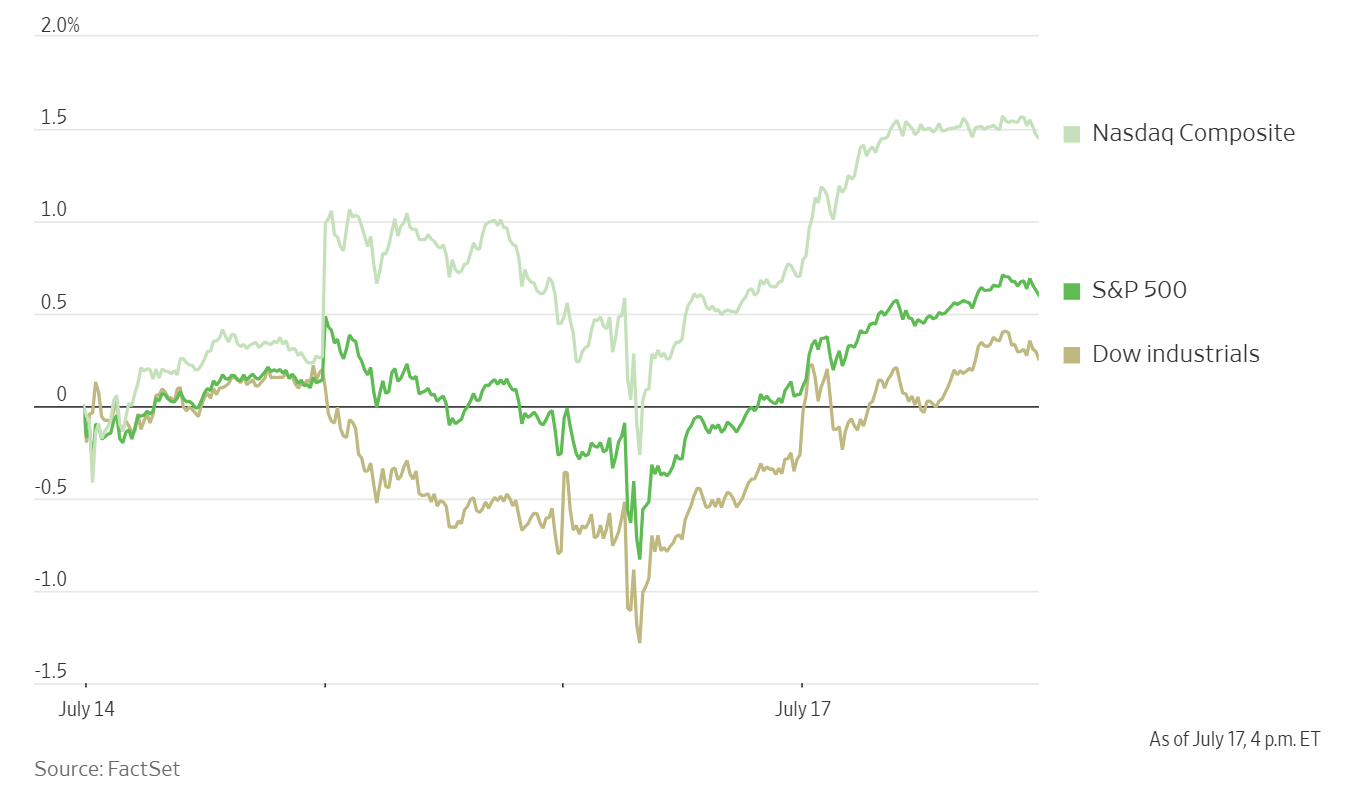

Markets closed at all-time highs with strong consumer spending data reversing May’s retail decline entirely. Jobless claims hit three-month lows, suggesting the labor market remains solid despite economic uncertainty.

Earnings season momentum accelerates

Taiwan Semiconductor $TSM ( ▼ 1.0% ) posted record quarterly profit while PepsiCo $PEP beat expectations and raised guidance. Corporate America is navigating tariffs better than feared with strong beat rates.

Major partnership reshapes EV landscape

Lucid Group $LCID ( ▼ 4.19% ) struck a robotaxi deal with Uber $UBER ( ▼ 1.58% ) for thousands of vehicles over six years, potentially transforming the struggling EV maker’s business model.

Fed independence debate intensifies

President Trump escalated attacks on Chair Powell while Wall Street’s biggest CEOs publicly defended central bank autonomy. Markets largely ignored the political theater.

Market Overview

U.S. Stock Indexes, This Week so Far

Stock Spotlight

Taiwan Semiconductor $TSM ( ▼ 1.0% ) delivered the quarter chip investors needed. Record quarterly profit beat estimates while Q3 revenue guidance came in above expectations. CEO C.C. Wei’s comment that Nvidia $NVDA regaining China chip sales is “very positive news for TSMC” signals significant upside if export restrictions continue easing.

PepsiCo $PEP ( ▼ 1.96% ) proved consumer staples remain resilient. Revenue beat estimates while management reduced their full-year profit decline forecast. The strategic shift toward healthier brands and energy drinks is working.

GE Aerospace $GE ( ▼ 3.77% ) raised 2025 guidance after crushing Q2 earnings expectations. Revenue also topped forecasts, though management warned of a significant tariff impact this year.

Big Name Updates

Netflix $NFLX ( ▲ 0.52% ) reports after the bell with analysts split on the streaming giant’s premium valuation. JPMorgan maintains caution with a Neutral rating while Bernstein raised its price target, citing the company’s industry moat. Subscriber growth and 2026 guidance will be key.

United Airlines $UAL ( ▼ 5.03% ) delivered mixed signals with Q2 earnings beating but 2025 guidance disappointing. The airline lowered its full-year expectations significantly from the original range. CEO Scott Kirby noted demand improved in early July, suggesting uncertainty may be fading.

Coca-Cola $KO ( ▼ 1.37% ) faces operational changes after Trump announced the company agreed to replace high-fructose corn syrup with “real cane sugar” in U.S. products. This pressured suppliers Archer-Daniels-Midland $ADM and Ingredion $INGR.

Other Notable Company News

Opendoor Technologies $OPEN ( ▲ 6.15% ) became the day’s meme stock after hedge fund manager Eric Jackson’s viral post calling it a potential “100-bagger over the next few years.” The real estate platform caught retail attention with comparisons to Carvana $CVNA turnaround story.

AMC Entertainment $AMC ( ▲ 2.54% ) gained on Benchmark’s raised estimates amid box office recovery. The firm sees strong year-over-year domestic admission growth per screen in Q2, well above prior estimates.

Starbucks $SBUX ( ▲ 1.59% ) faced pressure after Jefferies downgraded to underperform, arguing expectations have “settled too far ahead of reality” with no evidence of lasting improvements.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

The 10-year Treasury yield edged higher as robust retail sales and falling jobless claims reduced recession fears. Bond traders reduced September rate cut expectations significantly from last week.

• The dollar strengthened significantly on the DXY index as foreign exchange markets positioned for a more hawkish Federal Reserve stance

• Mortgage rates continued climbing with the 30-year fixed moving higher according to Freddie Mac

Policy Watch

President Trump confirmed plans to notify “well over 150 countries” of blanket tariffs, representing the broadest trade action proposed to date. Markets largely dismissed the announcement as negotiating theater.

The Federal Reserve independence debate intensified as Trump continued targeting Chair Powell over building renovation costs, labeling them potential “fraud.” However, Wall Street’s biggest names rallied to the Fed’s defense:

• JPMorgan $JPM CEO Jamie Dimon emphasized Fed independence importance

• Bank of America $BAC CEO Brian Moynihan called an independent Fed “key” to stability

• Goldman Sachs $GS CEO David Solomon said Fed independence is “something we should fight to preserve”

Meanwhile, the House moved forward with crypto legislation including stablecoin standards and digital asset frameworks, with Circle $CRCL gaining on the developments.

What to Watch

Netflix earnings catalyst

After the bell results could set Big Tech earnings season tone. Watch subscriber growth acceleration and management’s 2026 guidance as streaming wars intensify.

China export policy reversal

Reports suggest the U.S. may ease AI chip export restrictions to China. Nvidia $NVDA and AMD $AMD could regain billions in annual revenue if lower-end AI chips get approval.

Federal Reserve meeting positioning

With economic data strengthening, watch for communication shifts ahead of the July 31st meeting. Bond positioning suggests traders are reducing rate cut bets.

Robotaxi sector validation

The Lucid $LCID ( ▼ 4.19% ) Uber $UBER partnership could spark renewed interest in autonomous vehicle plays. Tesla $TSLA and other AV technology companies may benefit from sector legitimacy.

Retail earnings preview

With June sales beating expectations, upcoming results from Walmart $WMT and Target $TGT could confirm consumer resilience despite uncertainty.

Thanks for reading 🙂

- John

Today’s Sponsor

How to Hack a $1.3T Market

Forget concrete. The new foundation for real estate success is digital, and Pacaso leads the way. Their luxury co-ownership tech unlocks a $1.3T real estate market. They’ve already earned $110M+ in gross profits to date, including 41% YoY growth last year. They even reserved the Nasdaq ticker PCSO.

This is a paid advertisement for Pacaso's Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public.Listing on the Nasdaq is subject to approvals.

Note: This newsletter is intended for informational purposes only.