- Pivot & Flow

- Posts

- July 16th Market Overview

July 16th Market Overview

July 16th Market Overview (no fluff)

Happy Wednesday

Market hopped around today as Powell firing rumors put in some deep red candles very quickly, then Trump called it "highly unlikely" and everything bounced back. Banks beat earnings but nobody seemed to care with banking sector practically flat.

Fed independence is clearly something the market wants.

Let's dig in...

Curious about alternative investments? Access Institutional-Grade Alternative Investments with Long Angle

Summary

Powell Drama Shows Market's True Colors

Trump floated firing Fed Chair Powell to lawmakers, markets tanked, then Trump said "highly unlikely" and everything bounced back. If you needed proof that investors care more about Fed independence than anything else, today was it.

ASML Delivers Reality Check

Beat earnings but can't promise 2026 growth thanks to trade uncertainty. Q3 guidance came in light at 7.4-7.9 billion versus 8.3 billion expected. Turns out even the chip equipment kings aren't immune to geopolitical headaches.

Banks Win on Paper, Lose on Price

Goldman $GS ( ▼ 3.67% ) , BofA $BAC, and Morgan Stanley $MS ( ▼ 3.0% ) all smashed earnings on trading revenue, yet their stocks went nowhere. Sometimes the market cares more about tomorrow's problems than today's profits.

Trump's Tariff Playbook Revealed

Pharma tariffs start gentle, then ramp up hard after companies get a year to move production stateside. Semiconductors might be next in line. Meanwhile, EU officials are calling 30% tariffs "unacceptable" ahead of August's deadline.

Market Overview

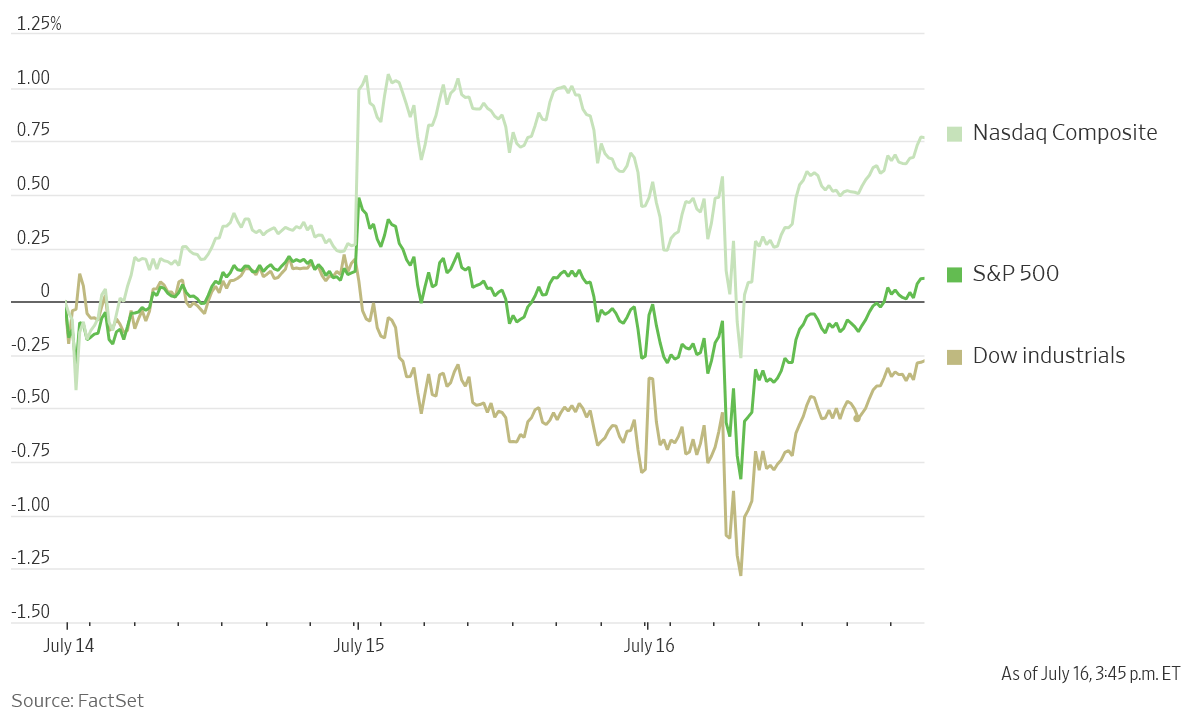

U.S. Stock Indexes, This Week so Far

Past 3 sessions

Stock Spotlight

Johnson & Johnson $JNJ ( ▼ 2.31% ) posted $2.77 per share and beat estimates. More importantly, they raised full-year guidance and cut their tariff hit from $400 million to $200 million.

ASML $ASML ( ▼ 2.22% ) beat earnings with €7.69 billion in revenue but said they can't promise 2026 growth. Q3 guidance came in light at €7.4-7.9 billion versus €8.3 billion expected. The chip equipment maker's honesty spooked investors.

Morgan Stanley $MS ( ▼ 3.0% ) earned $2.13 per share on $16.79 billion revenue, both beats. Trading desk made money hand over fist, but the stock went down anyway. Banks are hostage to Fed drama right now.

Big Name Updates

Nvidia $NVDA ( ▲ 0.16% ) got a Needham price target bump to $200. They see $3 billion quarterly from H20 chip sales to China plus new Blackwell GPUs launching this summer.

Amazon $AMZN ( ▲ 0.98% ) picked SpaceX for Kuiper satellite launches. Cantor raised their target to $260 but Bank of America dropped them from the US 1 list. Mixed signals there.

Apple $AAPL ( ▼ 0.85% ) might face iPhone import trouble. The ITC sided with Samsung $SSNLF over Chinese display maker BOE. Final ruling comes in November, giving Trump the call on any ban.

Meta $META ( ▼ 1.07% ) became Cantor's top pick with an $828 target. Alphabet $GOOGL ( ▼ 0.74% ) got bumped to $196 but stays neutral until August's antitrust decision.

Other Notable Company News

Ford $F ( ▼ 3.67% ) takes a $570 million Q2 hit for recalling 700,000 SUVs over fuel leak fire risks.

Motorola Solutions $MSI ( ▼ 2.31% ) got UBS coverage at Buy with a $490 target. They see value in the public safety tech business.

Rockwell Automation $ROK ( ▼ 1.27% ) upgraded to Buy at BofA with a $410 target. Industrial turnaround story gaining steam.

Rigetti Computing $RGTI ( ▼ 4.45% ) hit quantum fidelity on their 36-qubit system, cutting error rates in half. Planning 100+ qubit launch by year-end.

Sector Watch

Sector | Symbol |

|---|---|

Communication Services | |

Technology | |

Consumer Discretionary | |

Energy | |

Financials | |

Industrials | |

Utilities | |

Materials | |

Real Estate | |

Healthcare | |

Consumer Staples |

Bond Market

Treasury yields whipsawed on Powell speculation before settling lower. The 10-year note ended at 4.462% after initially spiking when firing reports surfaced.

• Long-dated bonds sold off as traders feared a less independent Fed could reignite inflation

• The 30-year yield jumped 0.1 percentage point before retreating on Trump’s denial of firing Powell

Policy Watch

Fed Independence: Goldman Sachs CEO David Solomon publicly defended Fed independence, calling it "very important and something we should fight to preserve." The market's reaction proves investors agree - political interference with monetary policy remains a red line.

Tariff Strategy: Trump outlined his pharmaceutical approach - start tariffs low, then ramp them "very high" after giving companies about a year to build domestic production. This timeline gives investors a roadmap for sector impact.

EU trade chief heads to Washington for meetings with Commerce Secretary Lutnick and USTR Greer

Danish official called threatened EU tariffs "completely unacceptable"

Administration nears executive order making private market investments more available in 401(k) plans

What to Watch

Bank Earnings Momentum

Three major banks beat but stocks fell anyway. Watch if this disconnect continues with JPMorgan Chase $JPM reporting Thursday.

Semiconductor Equipment Selloff

ASML's weak 2026 guidance could spread to other chip equipment makers this week. The sector's been on a seven-week run - this could be the reality check.

Powell's Next Move

His next public appearance will be scrutinized. How he responds to Trump's criticism could determine if this Fed drama continues or dies down.

EU Trade Deadline

August 1 is coming fast. Any breakthrough or escalation in talks could swing markets as uncertainty gets resolved one way or another.

Thanks for reading 🙂

- John

Today’s Sponsor

Where Accomplished Wealth Builders Connect, Learn & Grow

Long Angle is a private, vetted community for high-net-worth entrepreneurs and executives. No fees, no pitches—just real peers navigating wealth at your level. Inside, you’ll find:

Self-made professionals, 30–55, $5M–$100M net worth

Confidential conversations, peer advisory groups, live meetups

Institutional-grade investments, $100M+ deployed annually

Note: This newsletter is intended for informational purposes only.