- Pivot & Flow

- Posts

- How Time Zones Give Traders a Hidden Edge

How Time Zones Give Traders a Hidden Edge

Data From 40,000 Accounts Proves Location Matters

You know that feeling when you're dead tired and buy some random Amazon crap late at night? Like your brain just completely abandons you when you're running on no sleep?

Well, I read about this study that proves what we all suspected about sleep and bad financial decisions and they did it in the most clever way I've ever seen.

The problem: You can't exactly call up thousands of investors and say "hey, stay awake all night then trade some stocks for science."

But the UC researchers framed this study around an experiment that was already naturally occuring: America already runs this exact test every single day because of time zones.

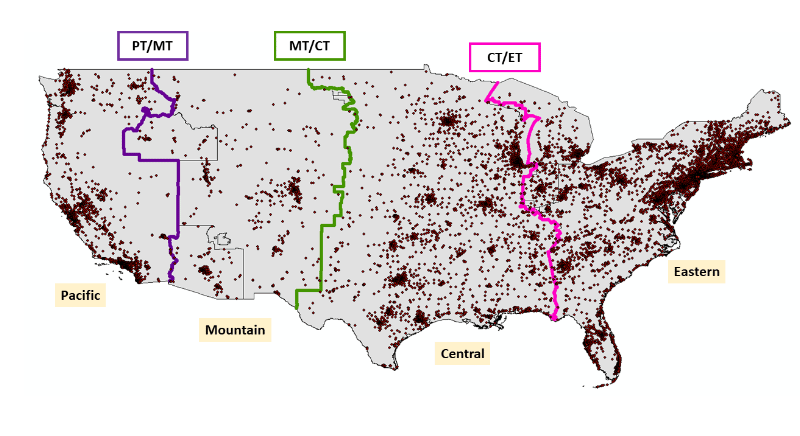

geographical distribution of 41,131 households in the contiguous United States based on the zip code information from the large discount brokerage data

Picture two traders living 50 miles apart same jobs, same lives, same bedtime. But one lives just east of a time zone border, the other just west. The east side guy consistently gets worse sleep because of later sunset timing. Same routine, worse sleep, all because of an invisible line on a map.

The study explains the mechanism as essentially this:

Later sunset = less darkness before bedtime = less melatonin production = worse sleep

People on the EAST side of time zone borders experience later sunsets in their local time

Therefore people on east side get worse sleep

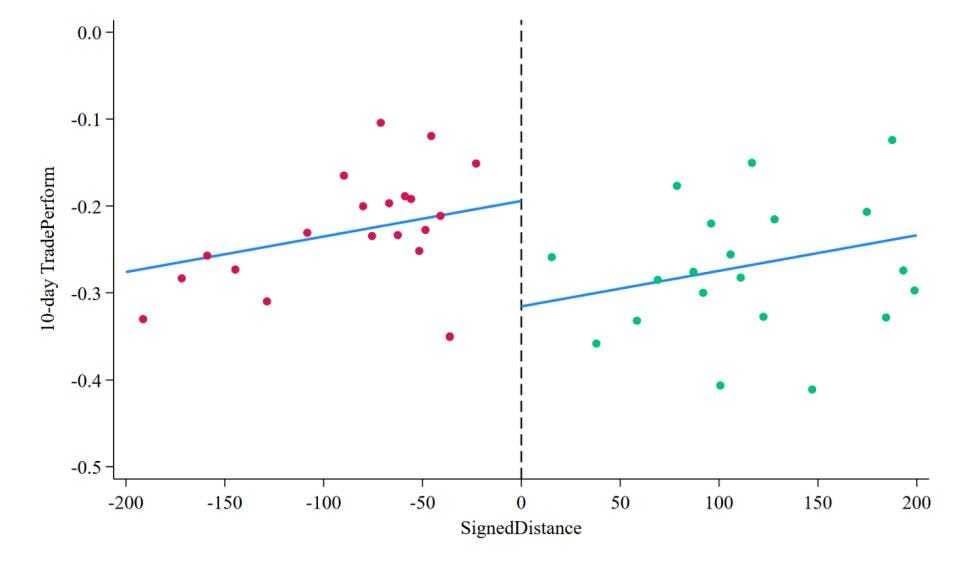

They tracked 41,131 retail trading accounts for six years. The results? People on the east side consistently underperformed by 11.3 basis points per day. That's a 2.4% monthly difference. Not margin of error, but the difference between a decent year and getting crushed.

This chart shows a sharp drop in trading performance right at the time zone border (the dashed line), with investors on the east side (green dots, who get worse sleep) consistently underperforming those on the west side (red dots) by about 10-12 basis points.

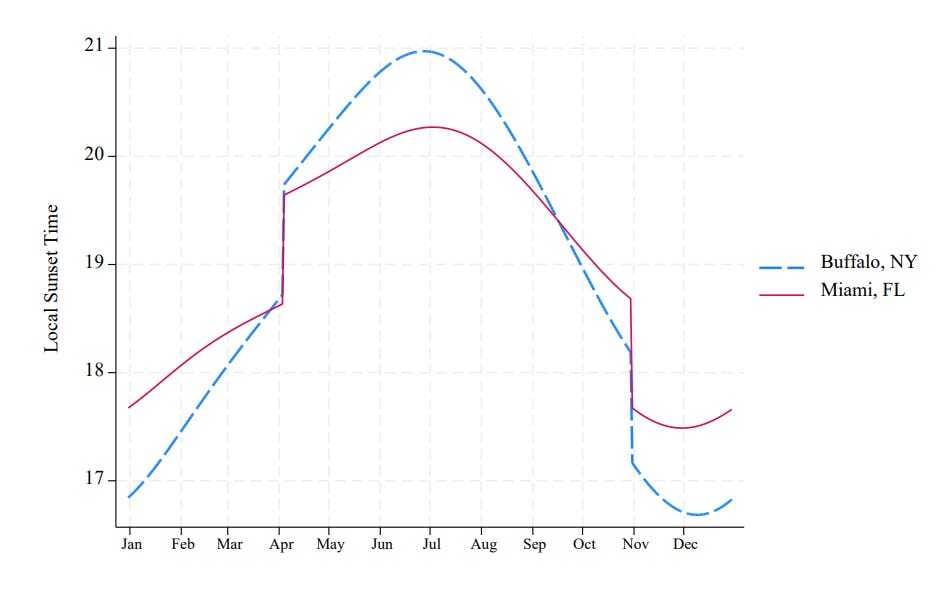

Why I personally trust these results? They tested it multiple ways. During summer, northern investors underperformed southern ones by 41 basis points daily (longer days = less sleep). In winter, they caught up. Even daylight saving time changes caused a 20-basis-point drop in performance.

This chart shows how Buffalo has later sunsets than Miami during summer (worse sleep for northerners) but earlier sunsets during winter (better sleep), creating a natural seasonal experiment that flips twice a year.

Sleep deprived investors/traders weren't typically more reckless, they were just less attentive. They missed earnings announcements and key information.

One hour of sleep difference was literally worth thousands (or 10’s of thousands+) of dollars a year. If you're tired, don't trade. Your zip code might be working against you, but your bedtime doesn't have to.

Stay curious 🙂

- John

Disclosure: This analysis reflects Pivot and Flow’s views and isn’t personalized advice. All investments carry risk, including complete loss of principal.

Today’s Sponsor

Most political news lives in the extremes.

It’s either rage bait meant to rile you up, or echo chambers that only reinforce what you already believe. The result? More division, less understanding — and a lot of burnout.

We give you the full story on one major political issue a day, broken down with arguments from the left, right, and center — plus clear, independent analysis. No spin. No shouting. No bias disguised as truth.

In just 10 minutes a day, you’ll actually understand what’s happening — and how all sides see it.

Join 400,000+ readers who are skipping the noise and getting the full picture.