- Pivot & Flow

- Posts

- "Fake" ESG is backfiring

"Fake" ESG is backfiring

How Greenwashing Costs Companies Real Money

Happy Sunday

A quick one here this Sunday. This is more about companies being dishonest vs. any kind of political agenda or ESG transparency. Markets tend to be bloodhounds when sniffing out dishonesty. In this case I’m looking at greenwashing defined as: “misleading the public to believe that a company or other entity is doing more to protect the environment than it is, greenwashing promotes false solutions to climate destruction that distract from and delay concrete and credible action”.

ESG

ESG investors initially focused on achieving better disclosure and transparency of companies' environmental and social practices. As transparency improved, the focus shifted to concerns about greenwashing. Today, companies that engage in misleading communication about their environmental or social practices get punished by investors. But how significant is this punishment in practice?

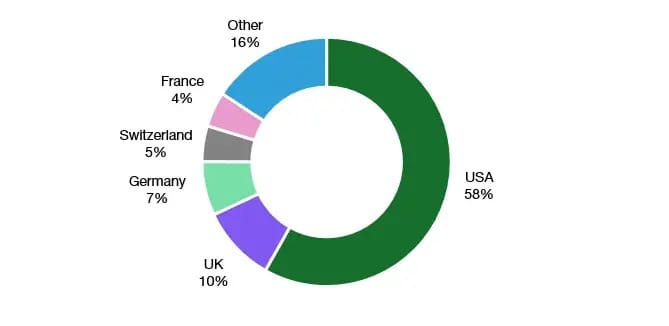

A new study examined more than 5,000 cases of greenwashing uncovered by RepRisk between 2007 and 2022. The research focused on the 12 largest developed stock markets, ensuring sufficient transparency, high corporate governance standards, and substantial institutional investor presence. The data shows that more than half of all greenwashing incidents involved US companies, with UK companies as the second most common culprits.

Source: Akyildirim et al. (2024)

Punishment varied significantly across countries. In the US, UK, and Canada, share prices fell more sharply following greenwashing incidents than in Japan and Australia. Continental European countries showed mixed results without clear trends.

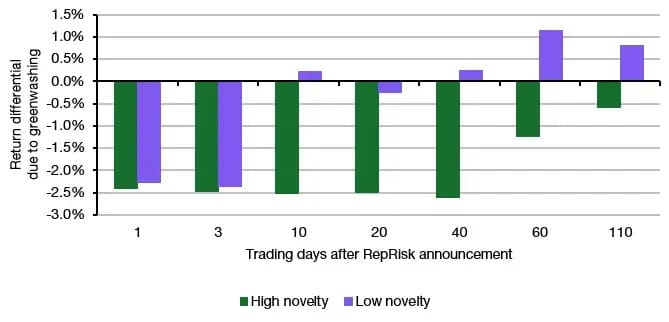

Looking at all incidents together reveals a clear pattern. A novel greenwashing incident (one reported by RepRisk for the first time) triggers an average 2.5% drop in share price in the days immediately following the alert. This underperformance persists for about two to three months before partially reverting. Even six months later, these companies still trade about 0.6% below similar companies that haven't had greenwashing incidents.

For repeat offenders, the market response diminishes. The data shows that companies with multiple greenwashing incidents see smaller price drops for subsequent violations. This suggests investors develop lasting skepticism toward companies with greenwashing histories. "Once a greenwasher, always a greenwasher" appears to be the market's motto.

Stay curious 🙂

- John

Today’s Sponsor

The Only AI That Knows All Your Work

Most AI tools start from scratch every time. ClickUp Brain already knows the answers.

It has full context of all your work—docs, tasks, chats, files, and more. No uploading. No explaining. No repetitive prompting.

ClickUp Brain creates tasks for your projects, writes updates in your voice, and answers questions with your team's institutional knowledge built in.

It's not just another AI tool. It's the first AI that actually understands your workflow because it lives where your work happens.

Join 150,000+ teams and save 1 day per week.